Apple’s ($AAPL) cash hoard set to top $250 BILLION – more than market value of Wal-Mart ($WMT)

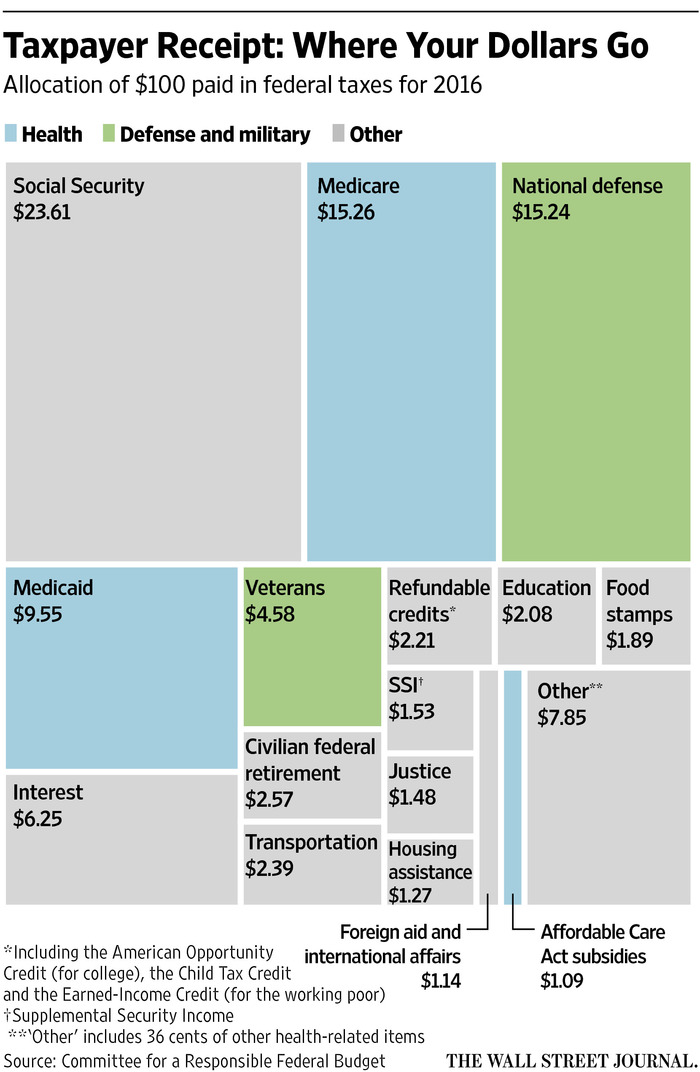

Apple Inc. is expected to report Tuesday that its stockpile of cash has topped a quarter of a trillion dollars. This is an unrivaled hoard that is greater than the market value of either Wal-Mart Stores Inc. or Procter & Gamble Co. It also exceeds the foreign-currency reserves held by the U.K. and Canada combined.

The money, more than 90% of which is stockpiled outside of the U.S., has drawn fresh attention as President Donald Trump has proposed slashing business taxes and granting a one-time tax holiday on corporate cash brought home. Those policies could ratchet up pressure on the tech giant to dole out more money to shareholders or make splashy acquisitions.

Apple’s quarterly results will show the company has doubled its cash in just over 4½ years. In the last three months of 2016, it racked up cash at a rate of about $3.6 million an hour.

Apple Chief Executive Tim Cook early this year said he was eager to bring cash home if tax changes enabled it. Chief Financial Officer Luca Maestri said such a move would give Apple flexibility to do more capital returns.

When Apple had its 1990s bankruptcy scare, then CEO Steve Jobs arranged an infusion from Microsoft, setting his resolve to keep reserves for emergencies. Mr. Jobs also believed Apple could better boost its stock price by using its money to develop products than through buybacks or dividends.

The cash topic has long been sensitive at Apple. Mr. Jobs, who saw Apple almost run out of cash after he returned to the company in 1996, frequently told colleagues he was against returning cash to shareholders. He was convinced to do a buyback in the wake of the Sept. 11, 2001, terrorist attacks as the stock market fell, according to a person familiar with the matter. After that, several executives thought the company should continue to do buybacks because the stock price seemed very cheap, this person said.

Apple hired bankers to study the impact of a buyback, according to this person, who said Mr. Jobs rejected the idea before it went anywhere.

Apple’s biggest product, the iPhone, has only supercharged the cash machine. Apple has sold more than 1 billion of the devices in the decade since it was introduced, and today claims 91% of all the profits in the smartphone sector.