Goldman says we are not repeating 2000 stock bubble

In a recent Wall Street Journal article, Goldman Sachs compared the top 5 companies in 2000 to the top 5 companies today. In that comparison, Goldman concludes that the market is not repeating the problems of 2000 that caused the stock bubble in today’s market.

The top 5 companies in the S&P 500 today are:

- Facebook Inc. [stckqut]FB[/stckqut],

- Apple Inc. [stckqut]AAPL[/stckqut],

- Amazon.com Inc. [stckqut]AMZN[/stckqut],

- Microsoft Corp. [stckqut]MSFT[/stckqut],

- Alphabet Inc. [stckqut]GOOGL[/stckqut].

and of 2000 were:

- Microsoft,

- Cisco Systems Inc. [stckqut]CSCO[/stckqut],

- General Electric Co. [stckqut]GE[/stckqut],

- Intel Corp. [stckqut]INTC[/stckqut],

- Exxon Mobil Corp. [stckqut]XOM[/stckqut].

The five companies in 2000 traded at 47 times expected earnings, according to Goldman. Today’s five biggest companies trade at 30 times expected earnings—making them by no means a bargain, but still less expensive than the stocks that dominated the stock run in the early 2000s.

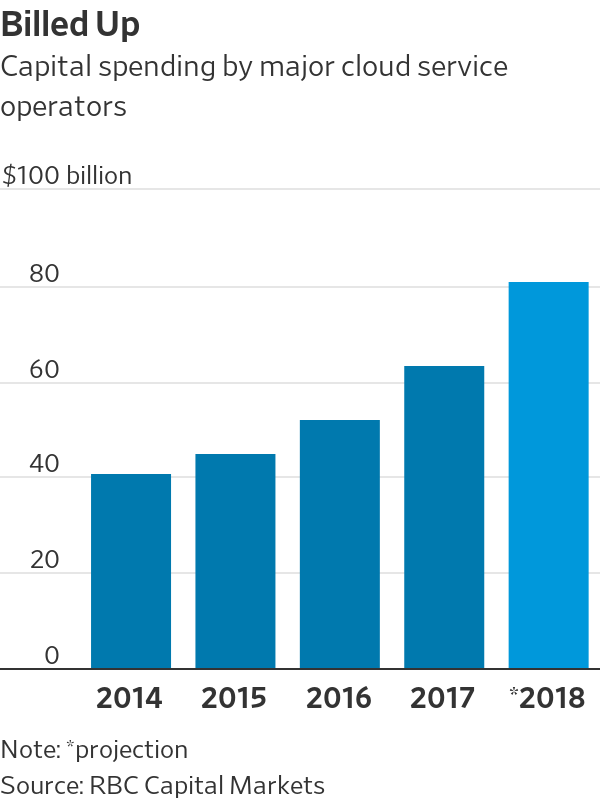

The tech giants powering the S&P 500 today also reinvest far more of their profits into their businesses than their predecessors did. The five companies funnel about 48% of their cash flow from operations into capital expenditure and research and development spending, according to Goldman, well above the S&P 500’s 21% average and the 26% average for the five biggest companies in March 2000.

According to Goldman, “Lower growth expectations, lower valuations and a greater reinvestment ratio suggest the current concentration may be more sustainable than it proved to be in 2000.”