Do you know how to evaluate a company for a dividend investment? Here is a primer

While I don’t typically invest in a company due to its dividends, others do. If you are one of those people, then you need to understand what to look for to make sure you are buying into a decent company. You need to be confident that your investment will be able to maintain or grow its dividend while not driving the company into the ground.

Dividends can (and should) flow from the cash flows derived from earnings, but there are other ways to pay out a dividend. Consider these other options. A company could pay out a dividend by:

- Draining its cash holdings.

- Selling off assets.

- Diluting your investment by issuing more shares of stock.

- Increasing its risk position by taking on more debt.

The problem here is that all of these options are temporary solutions. You eventually run out of cash and assets. Issuing more shares to pay shareholders can turn into a legal version of a Ponzi scheme. And increasing debt increases bankruptcy risk. Only long-term earnings power can sustainably fuel big dividends.

I have written a series of articles on how to read an annual report in 20 minutes. This is if you are choosing a stock after it has passed all of the standard metrics that I describe in my book, The Confident Investor. If you are buying the stock for another reason, such as for its dividend return, then you need to do more homework.

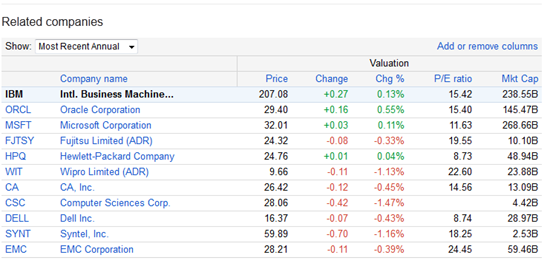

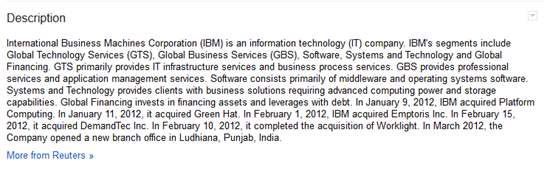

If you are choosing a stock based on its dividends, there are few things to check in the last 3 annual reports. Luckily, you really do not need to dig into the individual annual reports if you do not want to go through that effort. The information is in those reports, but free websites do most of the heavy lifting. You can find this information on the financial portals of Yahoo and MSN, but for my example I will use Morningstar. Go to Morningstar.com and search for GE. GE is the NYSE symbol for General Electric. Most people that own General Electric do so for its dividends and its exposure to the manufacturing sector and the international markets. According to Dividend.com, GE is currently offering a dividend yield of 3.27% and an annual payout of $0.76. This yield is not enough to get rich on, but it currently is beating your bank savings account.

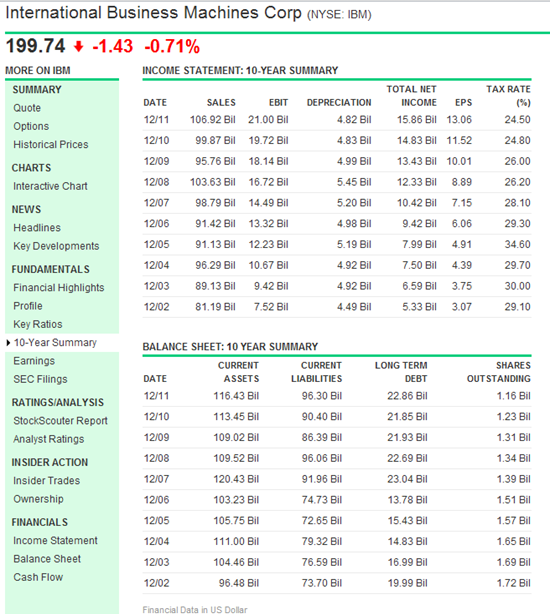

If you go to the quotes page of Morningstar for GE, you can see a quick overview of the company. Scroll down to the Financials section and you can follow along. The first thing I want to look for is not included in the above list. I want to make sure the company is growing its top line revenue over the last 3 years and that it has been profitable for the last 3 years. Note that this would be a different check if you were buying the company as a stock growth company but in this case we are buying it for dividends. We need to make sure the dividends are coming from a solid company and those dividends are not going to be disrupted. In the case of GE, you can see that both situations are true even though Net Income is the lowest it has been in the last 3 years. That drop in income would have been very troublesome if we were evaluating the Confident Investor Rating that I describe in my book. In the case of a dividend investment, it has maintained enough profit for us to feel confident in the continued profitability.

Now let’s jump over to the Financials tab and select the Cash Flow sub tab (immediately below the tabs are sub tabs). Scroll all the way to the bottom and we see that the Operating Cash Flow and Free Cash Flow are decreasing. This is a problem. We need this number to be increasing or at least steady to trust a dividend payout.

The next item is assets. Stay on the Financials tab, but go to the Balance Sheet sub tab. Look at the Net Property, Plant and Equipment line (it should be bold). This isn’t too bad. Over the last 5 years, it has gone up and down. The worst move was about 10%, but lately it has even increased a bit. This is a sign that the company is continuing to invest in its infrastructure and at least isn’t selling it off to satisfy its dividend needs.

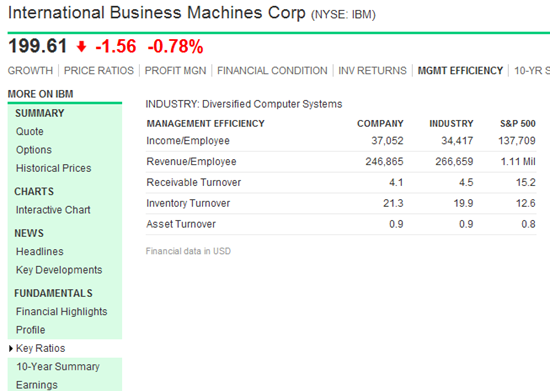

To check the number of shares outstanding, we can jump to the Key Ratios tab. Halfway down the Financials section is Shares. Here, we can see that the number of shares outstanding is essentially the same YOY for the last 3 years. This is fine.

For the last check, stay on the Key Ratios tab and look at the Key Ratios section. On the sub-tab Financial Health, you will see Total Liabilities. In this case, the liabilities are decreasing slightly. This means the company isn’t taking on debt to pay your dividend.

Overall, General Electric is a fairly safe dividend investment. While I don’t typically invest in a company due to its dividends, others do. If you are one of those people, then you need to understand what to look for to make sure you are buying into a decent company. You need to be confident that your investment will be able to maintain or grow its dividend while not driving the company into the ground.

The reality is that General Electric is not likely to decrease the dividend even though it has a few warning signs. Cutting a dividend almost always results in a drop in share price. Since executives and board members are usually paid with stock or receive bonuses based on stock price, they don’t want that price to drop. They will do unnatural acts if needed to maintain the stock price. This is the problem with focusing only on dividends for an investment. That addiction to the dividend can cause companies to make really bad decisions in the hopes that investors will not run from an ailing company. However, there is no free lunch for dividend owners. If you want to trust your dividend and hope that it can grow, choose companies that are extremely well run.

Do you have any questions about this? I would spend more time on this in a book, but hopefully this article gives you a few things to consider. Let me know below in the comments or send me a tweet at @ConfidentInvest.

Image is sourced from OpenClickart.com

[stckqut]GOOGL[/stckqut]