Rule #1 Don’t lose money!

Rule #2 If you do lose money, get out fast and find a better investment.

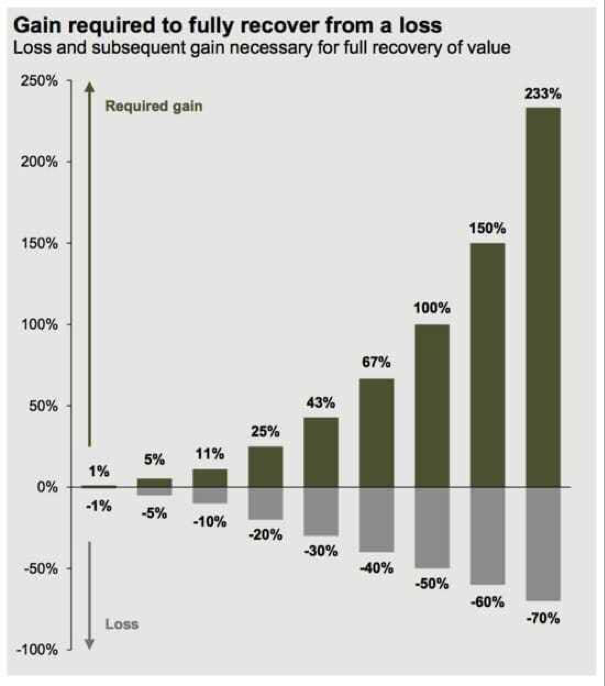

You do not need to stay with the same investment that put you into a hole. It takes far more growth to recover from a drop in stock price than it originally took to get there.

profile12345 (Ivan Ivanoff) on StockTwits put out a great chart to show the difficulty. I have reproduced it here.

It may be easier to understand with some simple math:

You have $100 investment in a stock. It has a bad run and drops $20 to $80 (a 20% loss). You now have $80. In order for you to grow $80 back to $100, you would need to increase the value of your holding 25% (or $20). Therefore a 20% loss takes a 25% gain to recover (see the image above).

The great thing is that you do not have to go home with the girl that you brought to the dance. Dump a bad stock. The chances that this stock will be the most efficient stock to recover your portfolio is almost zero. Surely, there is a different stock out there that is growing at the same time that this dog stock is falling. Even if your dog stock is starting to recover, there is probably a stock that is already running hard while your stock is trying to reverse course. Cut your losses and ride a better horse to the finish. There is no loyalty in the stock market.