5 Reasons To Lower Your Allocation To Riskier Assets

- Federal Reserve and the Rate Hike Quagmire. By itself, a bump up in overnight lending rates may not be a big deal. Conversely, participants may perceive inaction (an unwillingness to do anything) or too much activity (back-to-back rate hikes on wishy-washy data) as a major policy mistake.

- Extremely High Valuations and Eroding Domestic Internals. High valuations alone can always move higher; excitement can turn to euphoria. Yet history has rarely been kind to the combination of stock overvaluation and narrowing leadership (i.e., bad breadth).

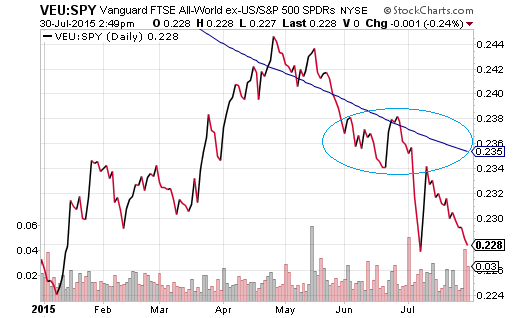

- Fading Effects Of Quantitative Easing/Other Stimulative Measures In Foreign Stocks. Both Europe and Japan had seen their prices surge shortly after confirmation of asset purchases. Over the last three months, those fortunes have cooled relative to the U.S. In some instances, as has been the case in China, stimulative measures that didn’t work eventually turned to direct (as opposed to indirect) market manipulation. Is the world losing faith in its central banks?

- The Return of Credit Risk Aversion In Bonds. Seven months into 2015 and the widely anticipated jump in 10-year yields is nowhere to be seen. In fact, the 10-year at 2.25% is roughly in the exact same place as it was when the year started. It has been lower (much lower); it has been higher, not far from 2.5%. Yet the bottom line is that treasuries via the iShares 7-10 Year Treasury Bond ETF (NYSEARCA:IEF) is rising in relative strength when compared with a high yield bond proxy like the iShares iBoxx $ High Yield Corporate Bond ETF (NYSEARCA:HYG).

- Economic Weakness in the U.S. and Across the Globe. Latin America, Asia, Europe. Name the region and the economic deterioration is palpable. In contrast, many portray the U.S. economy in a positive light. Headline unemployment is low, home prices are high and Q2 GDP at 2.3% is faster than what we witnessed in Q1. Yet labor force participation (employment) is at 1977 levels, home ownership is at the lowest levels since 1967 and GDP has grown at an anemic 2% over the last six years. That’s not what a recovery typically looks like. It is no wonder that revenue (sales) at U.S. corporations will be negative for the second consecutive quarter. And when both the quality of job growth as well as the weakness in revenues are tallied, nobody should be surprised at the snail’s pace of wage growth either (2%).

Source: 5 Reasons To Lower Your Allocation To Riskier Assets

It is not unusual for an investor to panic when a bear market emerges. A bear market is when the market is going down. Unfortunately, panic is the worst thing that you can do in a bear market. Instead, an investor should go out of his way to think rationally when the market is down in order to maximize profits when the market goes bullish or starts to go up.

It is not unusual for an investor to panic when a bear market emerges. A bear market is when the market is going down. Unfortunately, panic is the worst thing that you can do in a bear market. Instead, an investor should go out of his way to think rationally when the market is down in order to maximize profits when the market goes bullish or starts to go up.