KLA-Tencor Corporation ($KLAC) Possible Buy to $76 Confident Investor Rating: Good

| Company name | KLA-Tencor Corporation |

| Stock ticker | KLAC |

| Live stock price | [stckqut]KLAC[/stckqut] |

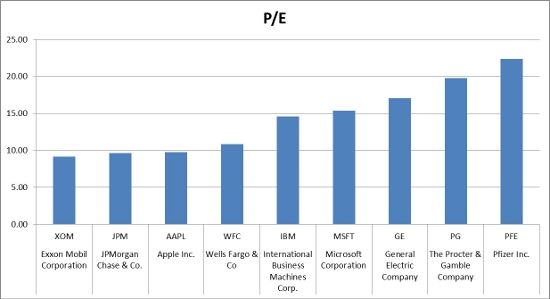

| P/E compared to competitors | Good |

MANAGEMENT EXECUTION

| Employee productivity | Good |

| Sales growth | Fair |

| EPS growth | Good |

| P/E growth | Good |

| EBIT growth | Good |

ANALYSIS

| Confident Investor Rating | Good |

| Target stock price (TWCA growth scenario) | $85.18 |

| Target stock price (averages with growth) | $101.9 |

| Target stock price (averages with no growth) | $77.07 |

| Target stock price (manual assumptions) | $66.4 |

The following company description is from Google Finance: http://www.google.com/finance?q=klac

KLA-Tencor Corporation (KLA-Tencor) is engaged in the design, manufacture and marketing of process control and yield management solutions for the semiconductor and related nanoelectronics industries. KLA-Tencor’s offerings include the Chip Manufacturing, Wafer Manufacturing, Reticle Manufacturing, Complementary Metal-Oxide-Semiconductor (CMOS) Image Sensors Manufacturing, Solar Manufacturing, light emitting diode (LED) Manufacturing, Data Storage Media/Head Manufacturing, Microelectromechanical Systems (MEMS) Manufacturing, and General Purpose/Lab Applications. It also provides refurbished KLA-Tencor tools as part of its K-T Certified program for customers manufacturing larger design-rule devices, as well as service and support for its products. The Company’s products are used in a number of other industries, including the LED, data storage and photovoltaic industries, as well as general materials research.

Confident Investor comments: At this price and at this time, I think that a Confident Investor can confidently invest in this stock.

If you would like to understand how to evaluate companies like I do on this site, please read my book, The Confident Investor.