Apple Peeled: Getting Under the Skin of iPhone Worries

Apple [stckqut]AAPL[/stckqut] is known for brutal efficiency, regularly killing off features and products that no longer serve its purposes.

So there is irony in the fact investors have taken a similarly ruthless view of Apple itself, penalizing the company heavily ahead of what is expected to be the slowest year on record for its key product: the iPhone. Apple’s share price ended 2015 down 4.6%, marking its first drop in seven years. That selloff looks overdone, even if one accepts the prevailing view that the iPhone 6s won’t sell at a pace anything like that of its predecessor.

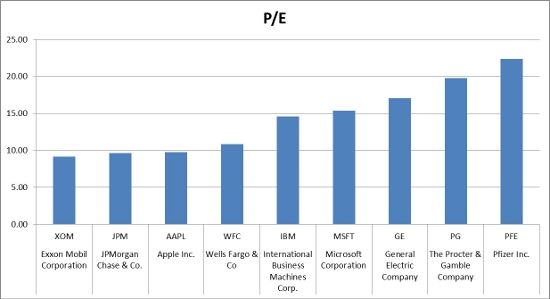

Consider that Apple is now the cheapest stock among the 10 largest tech companies in the S&P 500, once its huge net cash pile of $150 billion is excluded. That means Apple is cheaper than other growth-challenged giants like Microsoft [stckqut]MSFT[/stckqut], Oracle, Cisco Systems [stckqut]CSCO[/stckqut] and International Business Machines [stckqut]IBM[/stckqut].

Source: Apple Peeled: Getting Under the Skin of iPhone Worries

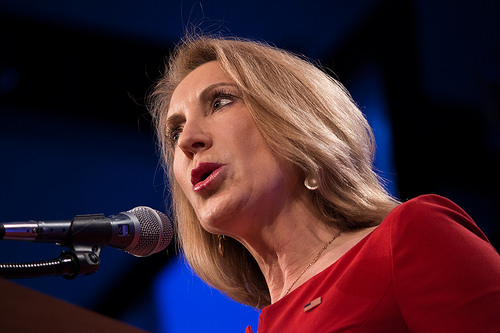

Carly Fiorina is currently a candidate for President of the United States of America. She is campaigning for the nomination of the Republican Party to run in the general election of 2016. According to her, one of her strengths is her business background. Most notable she speaks of her background as the first CEO of a DOW30 company: Hewlett-Packard [stckqut]HPQ[/stckqut].

Carly Fiorina is currently a candidate for President of the United States of America. She is campaigning for the nomination of the Republican Party to run in the general election of 2016. According to her, one of her strengths is her business background. Most notable she speaks of her background as the first CEO of a DOW30 company: Hewlett-Packard [stckqut]HPQ[/stckqut]. Ironically, her record at HP is one of the criticisms of Ms. Fiorina. Donald Trump is famous for criticizing her as a failed CEO, and he often cites

Ironically, her record at HP is one of the criticisms of Ms. Fiorina. Donald Trump is famous for criticizing her as a failed CEO, and he often cites