Carly Fiorina is currently a candidate for President of the United States of America. She is campaigning for the nomination of the Republican Party to run in the general election of 2016. According to her, one of her strengths is her business background. Most notable she speaks of her background as the first CEO of a DOW30 company: Hewlett-Packard [stckqut]HPQ[/stckqut].

Carly Fiorina is currently a candidate for President of the United States of America. She is campaigning for the nomination of the Republican Party to run in the general election of 2016. According to her, one of her strengths is her business background. Most notable she speaks of her background as the first CEO of a DOW30 company: Hewlett-Packard [stckqut]HPQ[/stckqut].

This site is purposefully non-political. While I tend to be a conservative and have voted for a Republican candidate more times than not, I do not want this site to reflect my personal political thoughts. I will occasionally point out a law or regulation that is tough on investors or the business community, but success at investing must be an apolitical activity. In fact, I have written that investors should probably ignore politics and political turmoil when investing.

I am writing this article simply to analyze the success of Ms. Fiorina or the lack thereof. I am fairly hard on companies and their management. It takes a lot to make my Watch List, and most companies cannot achieve that level of performance. I doubt that HP would have made that list while Ms. Fiorina was CEO, and it certainly cannot make that list today.

Ironically, her record at HP is one of the criticisms of Ms. Fiorina. Donald Trump is famous for criticizing her as a failed CEO, and he often cites the writings of Jeffrey Sonnenfeld. It is virtually impossible to compare the success of Donald Trump as CEO with Ms. Fiorina as CEO since Mr. Trump’s businesses are not public entities while most of Ms. Fiorina’s career has been with public entities. It is possible to dig into Ms. Fiorina and see just how lousy she was as the leader of a massive corporation.

Ironically, her record at HP is one of the criticisms of Ms. Fiorina. Donald Trump is famous for criticizing her as a failed CEO, and he often cites the writings of Jeffrey Sonnenfeld. It is virtually impossible to compare the success of Donald Trump as CEO with Ms. Fiorina as CEO since Mr. Trump’s businesses are not public entities while most of Ms. Fiorina’s career has been with public entities. It is possible to dig into Ms. Fiorina and see just how lousy she was as the leader of a massive corporation.

I will point out that there is an incredibly different scale in Ms. Fiorina’s career with Mr. Trump’s career. It is unlikely that in 1999-2005 (the time when Ms. Fiorina was CEO of HP) that Mr. Trump’s combined businesses would have cracked the Fortune 500 in revenue. In comparison, Ms. Fiorina was in the DOW30, which the Dow Jones company creates to give the best representation of the overall health of the stock market. In other words, Ms. Fiorina was in the big leagues while Mr. Trump was making a lot of personal money in the minor leagues.

So how did Carly Fiorina do as CEO?

It is probably best to take a look at her critics. Mr. Trump is fairly light on details, but he cites Mr. Sonnenfeld, so let’s look at his criticisms as revealed in Politico.

- In the five years that Fiorina was at Hewlett-Packard, the company lost over half its value.

- During those years, stocks in companies like Apple and Dell rose.

- Google [stckqut]GOOG[/stckqut] went public, and Facebook [stckqut]FB[/stckqut] was launched.

- The S&P 500 yardstick on major U.S. firms showed only a 7 percent drop.

- At a time that devices had become a low margin commodity business, Fiorina bought for $25 billion the dying Compaq computer company, which was composed of other failed businesses.

- The only stock pop under Fiorina’s reign was the 7 percent jump the moment she was fired following a unanimous board vote.

- Fiorina countered that she wasn’t a failure because she doubled revenues. That’s an empty measurement.

- She hasn’t had another CEO position since her time at HP

Let’s look at each of these accusations.

In the five years that Fiorina was at Hewlett-Packard, the company lost over half its value.

This is true and is a great reason that it was probably foolish to purchase the stock of HP in that time period. However, to accurately gauge the failure we must look at the reasonable peer group of HP. I contend that the reasonable peer group was Dell, Apple [stckqut]AAPL[/stckqut], Oracle [stckqut]ORCL[/stckqut], IBM [stckqut]IBM[/stckqut], Cisco [stckqut]CSCO[/stckqut], and EMC [stckqut]EMC[/stckqut]. I choose this group for several reasons. They are all quite large and, for the most part, they got their revenue at that time from either selling personal computers or from selling large and complicated systems to the IT departments of major companies.

Unfortunately, Google Finance only shows a weekly price for that long ago. While Ms. Fiorina joined HP on July 19, 1999, and left on February 9, 2005, those dates are not exactly available on Google Finance. The exact dates may be available on other sources but using Google Finance makes it easy for my readers to play with the dates as well as throw in other comparison companies.

If we look at the above chart it goes from July 9, 1999, to February 18, 2005. This is a very close approximation to Ms. Fiorina’s joining and departure dates. A quick appraisal shows that only Apple and Dell increased in value during this time frame. The other companies decreased in stock value, and most of them decreased in the same approximate range as HP.

In fact, you can see that several of these companies, including HP, had peak prices shortly after Ms. Fiorina joined HP. Many of the companies had significantly bigger drops than HP during the period. If we move the start date to March 2, 2000, you will see that most of these large enterprise-IT sellers had much larger drops in stock value than HP. Obviously, this was a major challenging time for companies that sold in the same market as HP. Even Apple dropped over 70% by the end of 2000. Remember, Apple at this time was not the amazing gadget, phone and entertainment content seller of today, but instead a computer company that was quite reliant on selling personal computers.

So who were the CEOs of these companies that obviously did just as bad as Ms. Fiorina?

At that time, Oracle was run by Larry Ellison, who renown as an amazing technology leader. Cisco was run by John Chambers, who has received CNN’s Top 25 Most Powerful People, Time Magazine’s “100 Most Influential People”, and Franklin Institute’s Bower Award for Business Leadership.

IBM was run by Lou Gerstner and Samuel Palmisano during that window. Mr. Gerstner was named a Knight Commander of the British Empire and received the Legend in Leadership Award from the Yale School of Management. Mr. Palmisano was awarded The Deming Cup.

So it doesn’t seem reasonable to condemn Ms. Fiorina as being terrible while her peers in peer companies that had similar and sometimes worse financial results were celebrated for years to come. The argument of condemning her based on the stock performance simply doesn’t make sense.

During those years, stocks in companies like Apple and Dell rose.

Yes, this is essentially true even if they both dropped in price along the way and then rebounded. However, Dell was already leading both HP and Compaq in market share prior to the merger. In fact, it was the fear of Dell that prompted the Compaq merger. HP’s problems weren’t the sale of personal computers where the business was not very strong. HP’s actual problem was they had a greater than 40% share of low-cost inkjet printers which meant that growth had to come from other segments of the business. It is very hard to grow a company’s market share over 40%. This means that new business had to come from other sources. Prior to Ms. Fiorina joining HP, the company had sold off its medical business, therefore selling to IT had to take up the slack.

Google went public, and Facebook was launched.

This is probably the most ludicrous statement that Mr. Sonnenfeld made in his article on Politico. Equating the success of companies in one market with the success of companies in another market is a classic amateur investor mistake. In my book, The Confident Investor, I try to explain why this is such a bad idea.

There is no reason to compare HP, Google, and Facebook. They are in completely different markets and offer completely different value propositions. Spending money that is going to Facebook, is not going to go to HP. Simply because a couple of young entrepreneurs were able to start a couple of software companies that offer a service on the Internet does not make them the same market as a provider of printers and computers.

Comparing Facebook and Google to HP is similar to comparing Harley-Davidson [stckqut]HOG[/stckqut] to General Motors [stckqut]GM[/stckqut] simply because they create products with tires. It makes no sense to make such a comparison. <!––nextpage––>

The S&P 500 yardstick on major U.S. firms showed only a 7 percent drop.

This is almost as bad as comparing HP to Google and Facebook. Yes, it does show that there are other industries or companies that are better investments. Yes, HP competes for investor dollars against the general market. However, comparing the performance of companies in disparate industries as a criticism to the CEO or management of the company is foolish. Other industries have other market forces that are affecting their customers and their suppliers. It is not logical to compare the success or the lack of success of a cereal manufacturer to a printer and personal computer manufacturer.

In fact, this metric defends Ms. Fiorina. By all accounts, HP needed to be transformed. HP hired Ms. Fiorina due to her leadership experience during the massive turmoil that happened at Lucent. HP’s board understood they needed someone to lead through that massive change, and Ms. Fiorina seemed like a great choice. In fact, an article in Businessweek at the time of the hiring said, “HP has seemed little more than part of the clueless.” This article was a very strong condemnation of the HP board and the previous HP leadership.

If the general market dropped by 7%, it was obviously a tough time to transform a company. Shame on HP’s board for letting the company get into such a mess even prior to hiring Ms. Fiorina. The company prior to her joining HP was simply not that well run, and the price that she inherited was likely a bubble that was growing around the company and carrying its shares up. In this environment, any bad economic news was going to hurt HP more than many companies. In this period, we had the global economic downturn that was caused by the terrorist activity of 9/11/01 – an event that hurt many companies.

HP sold a non-essential product to consumers and companies. It was easy for their customers to delay purchases of most of HP’s products for months or perhaps years. The only product that was essential was its printer refills business where an existing customer simply couldn’t operate the printer without the refill. For this reason, HP has a likelihood of higher volatility than the market. A down market with a company that was badly in need of transformation is ripe for a big downturn. The HP board set up HP to be in very bad shape, and Ms. Fiorina was almost doomed from the first day she got the job.

It makes far more sense to compare HP to its peers during that time rather than the market as a whole. Hopefully, I have effectively made that point earlier in this article.

At a time that devices had become a low margin commodity business, Fiorina bought for $25 billion the dying Compaq computer company, which was composed of other failed businesses.

This statement is an exaggeration at best and defies logic at worst.

This statement is an exaggeration at best and defies logic at worst.

First of all, at the ten-year mark after HP purchased Compaq many experts in the industry branded the event as a success. It transformed a company that needed to be transformed. In the words of HP to the press ten years later: “The combination of HP and Compaq built a business that achieved more together much faster than either company could on its own and built the foundation for the world’s largest technology company.”

Even some people that were skeptical of the merger such as Tommy Wald, CEO of White Glove Technologies thought that the result was a better company. “You look back now, and Carly [Fiorina, former HP CEO] was right – there was a lot of synergy between the two companies. The merger worked out well in retrospect.”

Geoffrey Lilien, president of Lilien Systems in Mill Valley, Calif., was a supporter of the merger originally and praised it ten years later. He said the addition of Compaq vastly improved HP’s presence in storage and industry-standard servers. “I think it was a fantastic move. I thought it was a fantastic move at the time, too. HP would definitely not be where it is today without Compaq.”

The reality is that Dell was beating HP and Compaq very badly at the time, and it would have been worse if they didn’t merge. They needed to join forces simply because their larger power made a stronger company to fight Dell. Granted, Dell prevailed for a while but the merger of Compaq and HP ultimately caused Dell to have to retrench and go private.<!––nextpage––>

The only stock pop under Fiorina’s reign was the 7 percent jump the moment she was fired following a unanimous board vote.

I question the wisdom of Mr. Sonnenfeld if he is looking for “stock pops” in his portfolio. The stock pop that he speaks of evaporated pretty rapidly. The pop was likely simply a relief of the backroom board fighting. I think I have already established that HP’s board at the time was not stellar, but a glimpse into their decisions shortly after Ms. Fiorina left shows their level of incompetence.

Immediately after firing Ms. Fiorina, the board hired Mr. Mark Hurd. Mr. Hurd is an extremely good manager, but ultimately left HP in disgrace. When Mr. Hurd left the company, Larry Ellison sung Mr. Hurd’s capabilities. Mr. Ellison is one of the longest-serving and most successful leaders in the technology industry. Mr. Ellison described the HP board as “idiots” and compared them to the board that removed Steve Jobs from Apple. That board went on to hire Léo Apotheker and then fired Mr. Apothker in less than 12 months.

The stock pop that Mr. Sonnenfeld was looking for doesn’t matter. Stock pops create temporary bubbles that almost always disappear. Mr. Hurd continued Ms. Fiorina’s basic transformation plan (ultimately buying EDS), but also instituted draconian cost savings that rid HP of top talent.

Fiorina countered that she wasn’t a failure because she doubled revenues. That’s an empty measurement.

Wow! I am simply floored by this statement. While there are many important metrics to consider when investing in a company, revenue growth has to be one of the most important. I teach the growth of four metrics in my book, The Confident Investor, but it is rare to have any other metric grow if revenue growth is not present. In the world of business, revenue fixes all ills. If you do not have increased revenue, it is incredibly difficult to fix the other problems with the company.

Had Ms. Fiorina not done the Compaq merger, it is very likely that HP would have had declining revenues. Remember, the stock market dropped 7% during her stay. Declining revenues would have been devastating for HP since it was already in trouble. HP would have likely been in a very bad situation had the Ms. Fiorina not purchased Compaq.

She hasn’t had another CEO position since her time at HP.

This is an empty statement. Understanding why a person does a personal act is extremely difficult to diagnose. In fact, based on the personal events of Ms. Fiorina’s life, it is not surprising that she did not pursue another CEO position at a large company.

In the world of investing, it is often discussed that a company executive sold some shares on the market. While this can be a sign that the company stock has peaked, it can also be a sign that the executive has kids attending college and needs to pay tuition. Or perhaps, the executive is donating money to a worthy cause. An insider sell is rarely as simple as it seems, even though an insider buy is at least an indicator of confidence in the stock.

Ms. Fiorina and her husband Frank lost a child in 2009. This tragedy would have been approximately the same time that she would have likely been joining another company as CEO. It is far more likely that this burden and grief were larger factors in her situation than a lack of opportunity.

In addition, it is fairly unusual for a CEO of a DOW30 company to join another company than not. There are some CEOs that have done it, but more than likely they will sit on boards of companies or charities as their daily financial needs are likely satisfied. The Wall Street Journal estimates that Ms. Fiorina has a net worth of $59M which essentially means she doesn’t need to work another day in her life.

Ms. Fiorina serves on several boards and has been fairly active in politics. She frequently is interviewed on talking heads political shows, and she was active in Senator McCain’s bid for President. She is or has been the chairperson of Good360, a member of the World Economic Forum, board member of Taiwan Semiconductor Manufacturing Company, board member of James Madison University and board chair of Opportunity International.

With this amount of wealth along with the varied interests and opportunities afforded to a former CEO of a DOW30 company, her lack of another CEO position is a false complaint.

Many will read this article and believe that I will support Carly Fiorina in the election for the President of the United States of America. I honestly do not know if that is where I will cast my vote. I live in Ohio and at the time of this writing, I have several months to decide whom to vote for in the Republican primaries. I then have several more months to decide to vote for Ms. Fiorina in the general election should she win the Republican nomination.

What I do know is that criticisms that she is the worst technology CEO of all time fall extremely short of reality. Was she the best CEO? Absolutely not. But accusations that Ms. Fiorina was terrible simply do not hold water for any reasonable analysis of the market HP was in, the state of HP at the time, and the board that she worked with at the time.

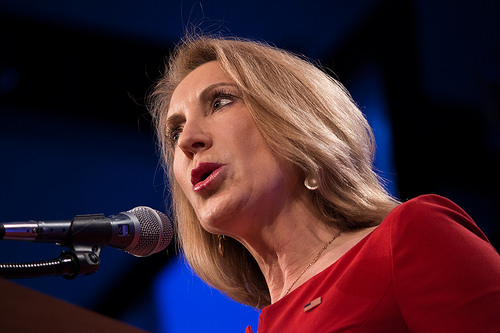

Photo by John Pemble

circa 2000, apple had little bushiness sales; ibm still had good mix (thinkpads, a star line), though i don’t know as % of gross sales; oracle is pure business AFAIK; hp is still mixed business/consumer.

Agree that google or facepoo are poor comparisons to hardware sellers.

It is a bit difficult to get a perfect comparison to HP at that time. They were the leader of printers at that time but most of their competition didn’t have the business products so one needs to look at technology oriented business and consumer products. There was a general trend at HP to do more with personal products e.g. the HP camera.