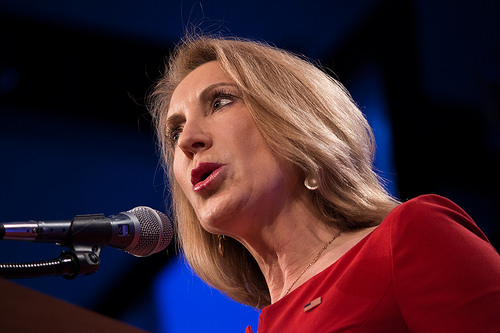

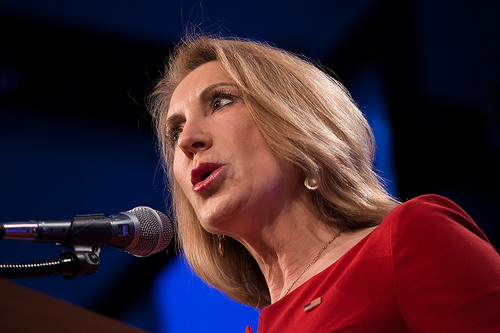

Was Carly Fiorina a failed CEO?

Carly Fiorina is currently a candidate for President of the United States of America. She is campaigning for the nomination of the Republican Party to run in the general election of 2016. According to her, one of her strengths is her business background. Most notable she speaks of her background as the first CEO of a DOW30 company: Hewlett-Packard [stckqut]HPQ[/stckqut].

Carly Fiorina is currently a candidate for President of the United States of America. She is campaigning for the nomination of the Republican Party to run in the general election of 2016. According to her, one of her strengths is her business background. Most notable she speaks of her background as the first CEO of a DOW30 company: Hewlett-Packard [stckqut]HPQ[/stckqut].

This site is purposefully non-political. While I tend to be a conservative and have voted for a Republican candidate more times than not, I do not want this site to reflect my personal political thoughts. I will occasionally point out a law or regulation that is tough on investors or the business community, but success at investing must be an apolitical activity. In fact, I have written that investors should probably ignore politics and political turmoil when investing.

I am writing this article simply to analyze the success of Ms. Fiorina or the lack thereof. I am fairly hard on companies and their management. It takes a lot to make my Watch List, and most companies cannot achieve that level of performance. I doubt that HP would have made that list while Ms. Fiorina was CEO, and it certainly cannot make that list today.

Ironically, her record at HP is one of the criticisms of Ms. Fiorina. Donald Trump is famous for criticizing her as a failed CEO, and he often cites the writings of Jeffrey Sonnenfeld. It is virtually impossible to compare the success of Donald Trump as CEO with Ms. Fiorina as CEO since Mr. Trump’s businesses are not public entities while most of Ms. Fiorina’s career has been with public entities. It is possible to dig into Ms. Fiorina and see just how lousy she was as the leader of a massive corporation.

Ironically, her record at HP is one of the criticisms of Ms. Fiorina. Donald Trump is famous for criticizing her as a failed CEO, and he often cites the writings of Jeffrey Sonnenfeld. It is virtually impossible to compare the success of Donald Trump as CEO with Ms. Fiorina as CEO since Mr. Trump’s businesses are not public entities while most of Ms. Fiorina’s career has been with public entities. It is possible to dig into Ms. Fiorina and see just how lousy she was as the leader of a massive corporation.

I will point out that there is an incredibly different scale in Ms. Fiorina’s career with Mr. Trump’s career. It is unlikely that in 1999-2005 (the time when Ms. Fiorina was CEO of HP) that Mr. Trump’s combined businesses would have cracked the Fortune 500 in revenue. In comparison, Ms. Fiorina was in the DOW30, which the Dow Jones company creates to give the best representation of the overall health of the stock market. In other words, Ms. Fiorina was in the big leagues while Mr. Trump was making a lot of personal money in the minor leagues.

So how did Carly Fiorina do as CEO?

It is probably best to take a look at her critics. Mr. Trump is fairly light on details, but he cites Mr. Sonnenfeld, so let’s look at his criticisms as revealed in Politico.

- In the five years that Fiorina was at Hewlett-Packard, the company lost over half its value.

- During those years, stocks in companies like Apple and Dell rose.

- Google [stckqut]GOOG[/stckqut] went public, and Facebook [stckqut]FB[/stckqut] was launched.

- The S&P 500 yardstick on major U.S. firms showed only a 7 percent drop.

- At a time that devices had become a low margin commodity business, Fiorina bought for $25 billion the dying Compaq computer company, which was composed of other failed businesses.

- The only stock pop under Fiorina’s reign was the 7 percent jump the moment she was fired following a unanimous board vote.

- Fiorina countered that she wasn’t a failure because she doubled revenues. That’s an empty measurement.

- She hasn’t had another CEO position since her time at HP

Let’s look at each of these accusations.

In the five years that Fiorina was at Hewlett-Packard, the company lost over half its value.

This is true and is a great reason that it was probably foolish to purchase the stock of HP in that time period. However, to accurately gauge the failure we must look at the reasonable peer group of HP. I contend that the reasonable peer group was Dell, Apple [stckqut]AAPL[/stckqut], Oracle [stckqut]ORCL[/stckqut], IBM [stckqut]IBM[/stckqut], Cisco [stckqut]CSCO[/stckqut], and EMC [stckqut]EMC[/stckqut]. I choose this group for several reasons. They are all quite large and, for the most part, they got their revenue at that time from either selling personal computers or from selling large and complicated systems to the IT departments of major companies.

Unfortunately, Google Finance only shows a weekly price for that long ago. While Ms. Fiorina joined HP on July 19, 1999, and left on February 9, 2005, those dates are not exactly available on Google Finance. The exact dates may be available on other sources but using Google Finance makes it easy for my readers to play with the dates as well as throw in other comparison companies.

If we look at the above chart it goes from July 9, 1999, to February 18, 2005. This is a very close approximation to Ms. Fiorina’s joining and departure dates. A quick appraisal shows that only Apple and Dell increased in value during this time frame. The other companies decreased in stock value, and most of them decreased in the same approximate range as HP.

In fact, you can see that several of these companies, including HP, had peak prices shortly after Ms. Fiorina joined HP. Many of the companies had significantly bigger drops than HP during the period. If we move the start date to March 2, 2000, you will see that most of these large enterprise-IT sellers had much larger drops in stock value than HP. Obviously, this was a major challenging time for companies that sold in the same market as HP. Even Apple dropped over 70% by the end of 2000. Remember, Apple at this time was not the amazing gadget, phone and entertainment content seller of today, but instead a computer company that was quite reliant on selling personal computers.Read More →