Harley-Davidson Inc ($HOG) Cautious Buy or Hold to $46 Confident Investor Rating: Fair

| Company name | Harley-Davidson Inc |

| Stock ticker | HOG |

| Live stock price | [stckqut]HOG[/stckqut] |

| P/E compared to competitors | Good |

MANAGEMENT EXECUTION

| Employee productivity | Good |

| Sales growth | Poor |

| EPS growth | Fair |

| P/E growth | Good |

| EBIT growth | Poor |

ANALYSIS

| Confident Investor Rating | Fair |

| Target stock price (TWCA growth scenario) | $45.57 |

| Target stock price (averages with growth) | $40.26 |

| Target stock price (averages with no growth) | $23.33 |

| Target stock price (manual assumptions) | $48.76 |

The following company description is from Google Finance: https://finance.google.com/finance?q=hog

Harley-Davidson, Inc. is the parent company for the groups of companies doing business as Harley-Davidson Motor Company (HDMC) and Harley-Davidson Financial Services (HDFS). The Company operates in two segments: the Motorcycles & Related Products (Motorcycles) and the Financial Services. The Motorcycles segment consists of HDMC, which designs, manufactures and sells at wholesale on-road Harley-Davidson motorcycles, as well as motorcycle parts, accessories, general merchandise and related services. The Company manufactures and sells at wholesale cruiser and touring motorcycles. The Financial Services segment consists of HDFS, which provides wholesale and retail financing and insurance-related programs to the Harley-Davidson dealers and their retail customers. HDFS is engaged in the business of financing and servicing wholesale inventory receivables and retail consumer loans for the purchase of Harley-Davidson motorcycles.

Confident Investor comments: At this time, I think that a Confident Investor can cautiously invest in Harley-Davidson Inc as long as the price is correct. Most of the fundamentals of this company are good but there are some concerns. Because of those concerns, I am removing Harley-Davidson from my Watch List.

If you would like to understand how to evaluate companies like I do on this site, please read my book, The Confident Investor. You can review the best companies that I have found (and I probably invest my own money in most of these companies) in my Watch List.

How was this analysis of Harley-Davidson Inc calculated?

For owners of my book, “The Confident Investor” I offer the following analysis (you must be logged in to this site as a book owner in order to see the following analysis). If you have registered and cannot see the balance of this article, make sure you are logged in and refresh your browser.

[s2If current_user_can(access_s2member_level1)]

In order to assist you in using the techniques of this book, the values that I used when calculating the Manual pricing above were:

- Stock price at the time of the calculation: $50.88

- Growth: 0.09

- Current EPS (TTM): $3.19

- P/E: 16

- Future EPS Calc: $4.9

- Future Stock Price Calc: $78.53

- Target stock price: $48.76

[/s2If]

I hope that this makes you a Confident Investor.

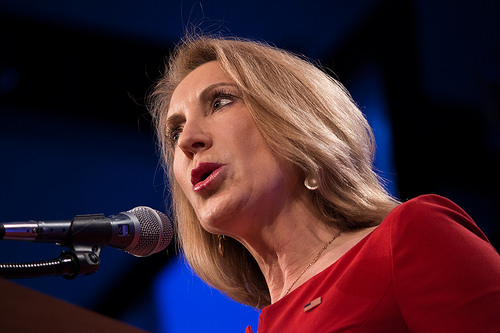

Carly Fiorina is currently a candidate for President of the United States of America. She is campaigning for the nomination of the Republican Party to run in the general election of 2016. According to her, one of her strengths is her business background. Most notable she speaks of her background as the first CEO of a DOW30 company: Hewlett-Packard [stckqut]HPQ[/stckqut].

Carly Fiorina is currently a candidate for President of the United States of America. She is campaigning for the nomination of the Republican Party to run in the general election of 2016. According to her, one of her strengths is her business background. Most notable she speaks of her background as the first CEO of a DOW30 company: Hewlett-Packard [stckqut]HPQ[/stckqut]. Ironically, her record at HP is one of the criticisms of Ms. Fiorina. Donald Trump is famous for criticizing her as a failed CEO, and he often cites

Ironically, her record at HP is one of the criticisms of Ms. Fiorina. Donald Trump is famous for criticizing her as a failed CEO, and he often cites