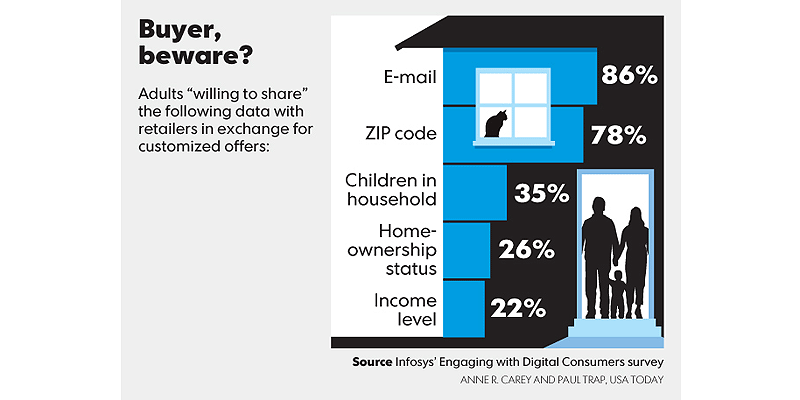

How much personal information are you willing to share for a good discount?

I thought this was an interesting (albeit small) infographic. How much personal information would you be willing to share to increase your discount?

I would share certain personal information. If I knew that I would do business again with the company, then I would be much more generous than if I thought I was not going to return. If I was not returning, then I would share bogus information and give out my email address that I reserve for getting spam. A more trusted retailer would get my personal email and more data about me.

I saw this image on a Twitter post from the USAToday.

How much personal info are you willing to share to get store deals? pic.twitter.com/81xUQAYKsd

— USA TODAY Money (@USATODAYmoney) December 28, 2013