NBC to move Leno?

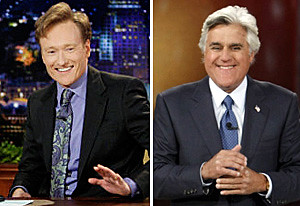

I am not a bit surprised that Leno is in trouble at NBC. Moving that format to 10P in the 21st century was foolish. It may have been okay in the 50s or 60s but that show was doomed the day that Jay Leno walked on to the stage.

Of course, it doesn’t help that Conan is a flop in the 11:30 time slot.

The executives that put this together should be fired. It should be the first thing that Comcast does now that they have control of the company from GE. Fire the buffoons that did this. Talk about destroying a valuable commodity! Warren Buffet says that you should only invest in companies that can be profitable even if idiots run them. I don’t know if I agree with that advice but I definitely don’t think you should invest in companies that are run by buffoons!

This must be why GE does so badly in my Confident Investor Rating – they simply do not know how to drive the value of their products. Hopefully, Comcast will do better.