I think NVIDIA Corporation ($NVDA) is a Possible Buy. It currently should be $375. Confident Investor Rating: Good

| Company name | NVIDIA Corporation |

| Stock ticker | NVDA |

| Live stock price | [stckqut]NVDA[/stckqut] |

| P/E compared to competitors | Fair |

MANAGEMENT EXECUTION

| Employee productivity | Good |

| Sales growth | Fair |

| EPS growth | Good |

| P/E growth | Good |

| EBITDA growth | Good |

| Price growth | Good |

| R&D growth | Good |

| Income growth | Good |

| Assets growth | Good |

| Return on Assets growth | Good |

| Income / Rev growth | Good |

| TWCA Plus | Good |

| Standard TWCA | Good |

| Weighted ann. stock price increase | Good |

ANALYSIS

| Confident Investor Rating | Good |

| Target stock price (TWCA growth scenario) | $560.82 |

| Target stock price (averages with growth) | $639.43 |

| Target stock price (averages with no growth) | $406.47 |

| Target stock price (manual assumptions) | $352.29 |

The following company description is from Reuters: https://finance.yahoo.com/quote/nvda/profile?p=nvda

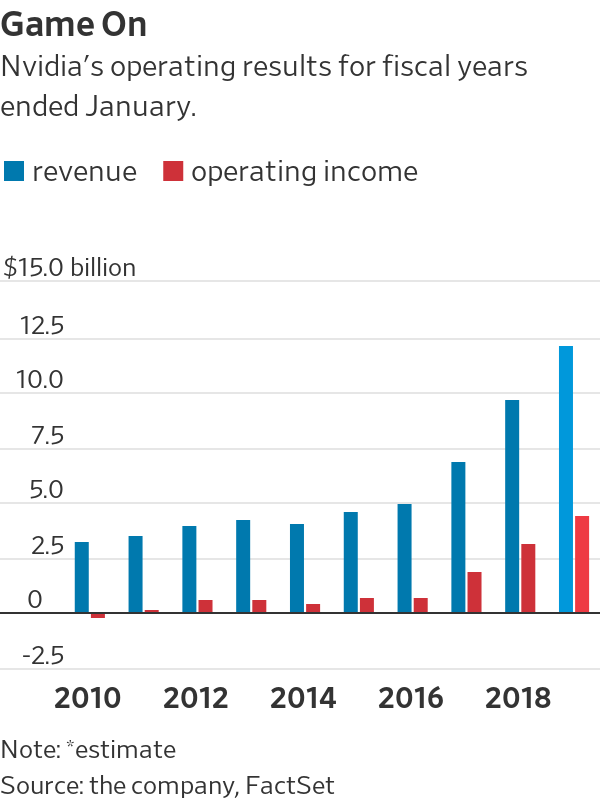

NVIDIA Corporation operates as a visual computing company worldwide. It operates in two segments, GPU and Tegra Processor. The GPU segment offers processors, which include GeForce for PC gaming and mainstream PCs; GeForce NOW for cloud-based gaming; Quadro for design professionals working in computer-aided design, video editing, special effects, and other creative applications; Tesla for artificial intelligence (AI) utilizing deep learning, accelerated computing, and general purpose computing; GRID, which provides power of NVIDIA graphics through the cloud and datacenters; DGX for AI scientists, researchers, and developers; and EGX for accelerated AI computing at the edge. The Tegra Processor segment provides processors comprising SHIELD devices and services designed to harness the power of mobile-cloud to revolutionize home entertainment, AI, and gaming; AGX, a power-efficient AI computing platform for intelligent edge devices; DRIVE AGX for self-driving vehicles; Clara AGX for medical instruments; and Jetson AGX for robotics and other embedded use. The company’s products are used in gaming, professional visualization, datacenter, and automotive markets. NVIDIA Corporation sells its products to original equipment manufacturers, original device manufacturers, system builders, add-in board manufacturers, retailers/distributors, Internet and cloud service providers, automotive manufacturers and tier-1 automotive suppliers, mapping companies, start-ups, and other ecosystem participants. NVIDIA Corporation was founded in 1993 and is headquartered in Santa Clara, California.

Confident Investor comments: At this price and at this time, I think that a Confident Investor can confidently invest in NVIDIA Corporation as long as the indicators that I describe in my book The Confident Investor are favorable.

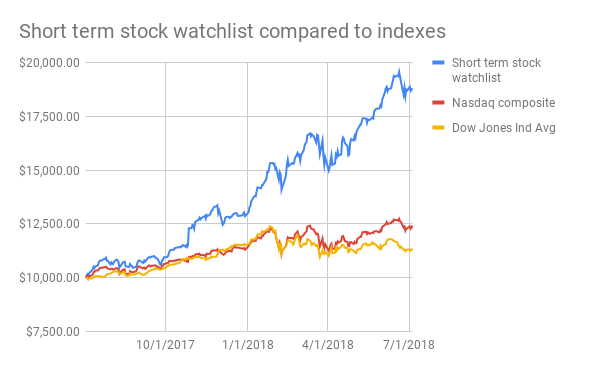

If you would like to understand how to evaluate companies like I do on this site, please read my book, The Confident Investor. You can review the best companies that I have found (and I probably invest my own money in most of these companies) in my Watch List.

How was this analysis of NVIDIA Corporation calculated?

For owners of my book, “The Confident Investor” I offer the following analysis (you must be logged in to this site as a book owner in order to see the following analysis). If you have registered and cannot see the balance of this article, make sure you are logged in and refresh your browser.

[s2If current_user_can(access_s2member_level1)]

In order to assist you in using the techniques of this book, the values that I used when calculating the Manual pricing above were:

- Stock price at the time of the calculation: $362.74

- Growth: 0.2

- Current EPS (TTM): $4.5

- P/E: 50.6691435032844

- Future EPS Calc: $11.19

- Future Stock Price Calc: $567.36

- Target stock price: $352.28

[/s2If]

I hope that this makes you a Confident Investor.