My favorite 15 stocks to start the 2nd half of the year (they grew by 88% the last 12 months)

We are halfway through the year! How is your portfolio doing?

We are halfway through the year! How is your portfolio doing?

I offer my 15 recommended stocks for the 3rd 3 months of 2018 – the third quarter of the year. I cannot list the worst stocks, as there are too many of those to itemize. I can at least list the 15 recommended stocks that will give you a good basis for the next three months of 2018.

Many sites do all year lists, but I am only committing to this list for the next three months. There is a great reason for this limitation. It is almost impossible to predict the market farther out than 3-6 month. In fact, it is quite possible for the market to do a massive correction and even this list would be a fallacy. There is always some risk with any investment and you are encouraged to read this site’s disclaimer before acting on this list.

I would expect all of these companies to maintain their status as Good Companies on my Watch List. I would not expect all of them to make a top 15 recommended stocks list in the last quarter of 2018. Some of them will grow a bit slower than I expect, and a couple of the 15 recommended stocks are probably going to lose money. As Peter Lynch famously said:

“In this business if you’re good, you’re right six times out of ten. You’re never going to be right nine times out of ten.”

I hope to be right on this list with 12 of these picks, but Peter says I should be happy with 9. I don’t expect all 15 recommended stocks to be massive growth stocks in the year. I also think the list is successful if the list of 15 beats the Nasdaq Composite and the Dow30. In October, I plan to publish a list for the last quarter of the year.

All of the stocks on this list are rated as Good Companies using the method that I describe in my book The Confident Investor. You can purchase my book wherever books are sold such as Amazon, Barnes and Noble, and Books A Million. It is available in e-book formats for Nook, Kindle, and iPad.

The 15 recommended stocks were chosen from Good Companies on my Watch List. This means we already know they are fairly well managed and have a history of solid growth. While all of the stocks on the Watch List are well run, these 15 recommended stocks seem to be the most well set up for aggressive growth in the third quarter of 2018.

The 15 recommended stocks for the third quarter of 2018 also performed very well over the past 12 months and the past 3 years. As I have written before, the past is not a perfect indicator of the future, but it is probably the best indicator that we have to use.

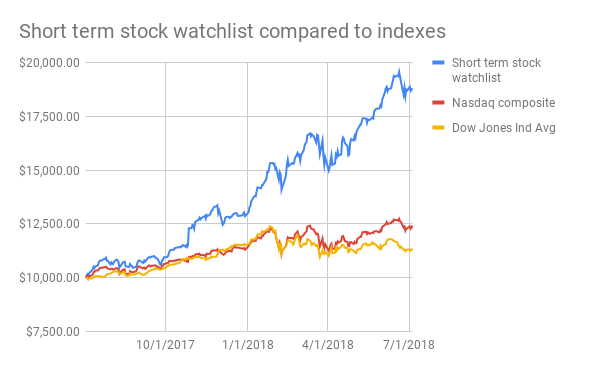

To show this strong performance, I will plot the growth of these 15 companies compared to several indices. My 15 stocks significantly outperformed the Dow Jones and Nasdaq Composite. My list had an annual growth of 87.97%, while the others grew at 13.40% and 24.16% respectively.

In other words, my list beat the market in the last 12 months by over 350%! For every dollar that you could have earned in an index fund, you would have earned $3.50 (or more) with my Short Term List.

The above chart shows what would have happened if you invested $10,000 in my Short Term list compared to investing $10,000 in an index.

I didn’t try to make this list of 15 recommended stocks to be a balanced portfolio covering multiple industries. I am happy to report that it isn’t terribly unbalanced. The reality is that if you plan to rebalance your portfolio every 3 months, then you really do not have to worry too much about industry balance.

If you want a more balanced portfolio, you should have approximately 30% of your portfolio invested in index funds. These funds should be divided by large and small-cap funds, an index bond fund, and an index international fund. This would help to balance your portfolio.

You could also look at the Watch List of stocks. These stocks have shown that they are well-run companies. If you are concerned about a balanced portfolio, I suggest that you compliment the 15 recommended stocks with a couple stocks from the Watch List.

The list of 15 recommended stocks for the first quarter of 2018

The list of 15 recommended stocks for the first quarter of 2018 sorted alphabetically by stock symbol are:

- ABIOMED, Inc. Info – Chart

- Adobe Systems Incorporated Info – Chart

- Align Technology, Inc. Info – Chart

- Amazon.com, Inc. Info – Chart

- Arista Networks Inc Info – Chart

- Heska Corp Info – Chart

- LGI Homes Inc Info – Chart

- Lululemon Athletica inc. Info – Chart

- Mastercard Inc Info – Chart

- Micron Technology, Inc. Info – Chart

- Netflix, Inc. Info – Chart

- Insperity Inc Info – Chart

- NVIDIA Corporation Info – Chart

- TriNet Group Inc Info – Chart

- WellCare Health Plans, Inc. Info – Chart

If you want to know a bit more about the companies that comprise the 15 recommended stocks for the 3rd quarter of 2018, you can read below. The descriptions primarily came from the short paragraph descriptions about the company found on Reuters. https://www.google.com/finance. You can also click on a company name on the right side of this site, under the heading of Most Reviewed Companies (you may need to scroll down) as most of the companies on this list have been reviewed here several times.

- ABIOMED, Inc. [stckqut]ABMD[/stckqut]

- ABIOMED, Inc., incorporated on June 4, 1987, is a provider of temporary percutaneous mechanical circulatory support devices. The Company offers care to heart failure patients. The Company operates in the segment of the research, development and sale of medical devices to assist or replace the pumping function of the failing heart. The Company develops, manufactures and markets products that are designed to enable the heart to rest, heal and recover by improving blood flow to the coronary arteries and end-organs and/or temporarily performing the pumping function of the heart. The Company’s product portfolio includes the Impella 2.5, Impella CP, Impella RP, Impella LD, Impella 5.0 and AB5000. Its products are used in the cardiac catheterization lab (cath lab), by interventional cardiologists, the electrophysiology lab, the hybrid lab and in the heart surgery suite by heart surgeons.

- Adobe Systems Incorporated [stckqut]ADBE[/stckqut]

- Adobe Systems Incorporated, incorporated on May 9, 1997, is a software company. The Company offers a line of products and services used by professionals, marketers, knowledge workers, application developers, enterprises and consumers for creating, managing, delivering, measuring, optimizing and engaging with compelling content and experiences across multiple operating systems, devices and media. The Company operates through three segments: Digital Media, Digital Marketing, and Print and Publishing. The Company markets and licenses its products and services directly to enterprise customers through its sales force and to end users through application stores and its own Website at www.adobe.com. It offers various products through a software-as-a-service (SaaS) model or a managed services model (both of which are referred to as a hosted or cloud-based model), as well as through term subscription and pay-per-use models.

- Align Technology, Inc. [stckqut]ALGN[/stckqut]

- Align Technology, Inc., incorporated on April 3, 1997, designs, manufactures and markets a system of clear aligner therapy, intra-oral scanners and computer-aided design/computer-aided manufacturing (CAD/CAM) digital services used in dentistry, orthodontics and dental records storage. The Company operates through two segments: Clear Aligner segment and Scanner and Services (Scanner) segment. The Clear Aligner segment consists of its Invisalign System, which includes Invisalign Full, Teen and Assist (Comprehensive Products), Express/Lite (Non-Comprehensive Products) and Vivera Retainers, along with its training and ancillary products for treating malocclusion (Non-Case). The Scanner segment consists of intra-oral scanning systems and other services available with the intra-oral scanners that provide digital alternatives to the traditional cast models. The Scanner segment includes its iTero scanner and OrthoCAD services. iTero scanner is used by dental professionals, and labs and services for restorative and orthodontic digital procedures, as well as Invisalign digital impression submission.

- Arista Networks Inc [stckqut]ANET[/stckqut]

- Arista Networks, Inc., incorporated on December 2, 2011, is a supplier of cloud networking solutions that use software innovations to address the needs of Internet companies, cloud service providers and data centers for enterprise support. The Company develops, markets and sells cloud networking solutions, which consist of its Gigabit Ethernet switches and related software. The Company’s cloud networking solutions consist of its Extensible Operating System (EOS), a set of network applications and its Ethernet switching and routing platforms. The programmability of EOS has allowed the Company to create a set of software applications that address the requirements of cloud networking, including workflow automation, network visibility, and analytics, and has also allowed it to integrate with a range of third-party applications for virtualization, management, automation, orchestration and network services. EOS supports cloud and virtualization solutions, including VMware NSX, Microsoft System Center, OpenStack and other cloud management frameworks.

- Heska Corp [stckqut]HSKA[/stckqut]

- Heska Corporation, incorporated on March 27, 1997, sells veterinary diagnostic and specialty products. The Company operates through two segments: Core Companion Animal Health (CCA) and Other Vaccines, Pharmaceuticals and Products (OVP). The CCA segment includes, primarily for canine and feline use, blood testing instruments and supplies, digital imaging products, software and services, local and cloud-based data services, allergy testing and immunotherapy, and single-use offerings, such as in-clinic diagnostic tests and heartworm preventive products. Its OVP segment includes private label vaccine and pharmaceutical production, primarily for cattle but also for other species, including equine, porcine, avian, feline and canine. All OVP products are sold by third parties under third-party labels. The Company focuses on supporting veterinarians in the canine and feline healthcare space.

- LGI Homes Inc [stckqut]LGIH[/stckqut]

- LGI Homes, Inc., incorporated on June 26, 2013, is a homebuilder and land developer. The Company is engaged in the design, construction, marketing and sale of new homes in markets in Texas, Arizona, Florida, Georgia, New Mexico, South Carolina, North Carolina, Colorado, Washington, and Tennessee. The Company operates through five segments: the Texas division, the Southwest division, the Southeast division, the Florida division, and the Northwest division. The Texas division includes homebuilding operations in Houston, Dallas/Fort Worth, San Antonio and Austin locations. The Southwest division includes homebuilding operations in Phoenix, Tucson, Albuquerque, Denver and Colorado Springs locations. The Southeast division includes homebuilding operations in Atlanta, Charlotte and Nashville locations. The Florida division includes homebuilding operations in Tampa, Orlando, Fort Myers and Jacksonville locations. The Northwest division includes homebuilding operations in Seattle location. The Company’s product offerings include entry-level homes and move-up homes sold under its LGI Homes brand, and its luxury series homes, which are sold under its Terrata Homes brand. As of December 31, 2016, the Company had 59 active communities with its LGI Homes brand and four with its Terrata Homes brand. The Company provides information regarding floor plans and pricing, credit and income qualifications and conduct tours of its homes. In addition, it provides each homebuyer with an introduction to the community and the surrounding area, providing them with information regarding utilities, schools, homeowners association dues and restrictions, local entertainment and nearby dining and shopping options. It offers a set number of floor plans in each community with features that include upgrades, such as granite countertops, appliances, and ceramic tile flooring.

- Lululemon Athletica inc. [stckqut]LULU[/stckqut]

- lululemon athletica inc., incorporated on November 21, 2005, is a designer, distributor, and retailer of athletic apparel. The Company operates through two segments: Company-operated stores and Direct to the consumer. The Company is also engaged in the sale from outlets, showrooms, sales from temporary locations, sales to wholesale accounts, warehouse sales, and license and supply arrangements. As of January 29, 2017, the Company had operated 406 stores located in the United States, Canada, Australia, the United Kingdom, New Zealand, China, Hong Kong, Singapore, South Korea, Germany, Puerto Rico and Switzerland. Its direct to consumer segment generates revenue from its lululemon and ivivva e-commerce websites, www.lululemon.com and www.ivivva.com, and other country and region-specific websites. The Company operates and distributes finished products from its owned or leased distribution facilities in the United States, Canada, and Australia. The Company owns its distribution center in Columbus, Ohio, and leases its other distribution facilities. The Company offers a range of apparel and accessories for women, men and female youth. Its apparel assortment includes items, such as pants, shorts, tops, and jackets designed for healthy lifestyle and athletic activities, such as yoga, running, training, most other sweaty pursuits, and athletic wear for female youth. It also offers fitness-related accessories, including an array of items, such as bags, socks, underwear, yoga mats and water bottles. Most of its Company-operated stores are branded lululemon, 55 of its Company-operated stores are branded ivivva and specialize in athletic wear for female youth. Its retail stores are located primarily in street locations, in lifestyle centers, and in malls. The Company competes with Nike, Inc., adidas AG, Under Armour, Inc., The Gap, Inc. and L Brands, Inc.

- Mastercard Inc [stckqut]MA[/stckqut]

- MasterCard Incorporated, incorporated on May 9, 2001, is a technology company that connects consumers, financial institutions, merchants, governments and businesses across the world, enabling them to use electronic forms of payment. The Company operates through Payment Solutions segment. The Company allows a user to make payments by creating a range of payment solutions and services using its brands, which include MasterCard, Maestro, and Cirrus. The Company provides a range of products and solutions that support payment products, which customers can offer to their cardholders. The Company’s services facilitate transactions on its network among cardholders, merchants, financial institutions, and governments. The Company’s products include consumer credit and charge, commercial, debit, prepaid, commercial and digital. The Company’s consumer credit and charge offers a range of programs that enable issuers to provide consumers with cards allowing users to defer payment. The Company’s debit supports a range of payment products and solutions that allow its customers to provide consumers with access to funds in deposit and other accounts. The Company offers prepaid payment programs using any of its brands, which it supports with processing products and services. The Company focuses on segments, which include government programs, such as social security payments, unemployment benefits, and others; commercial programs, such as payroll, health savings accounts, employee benefits and others, and consumer reloadable programs for individuals and users of electronic payments. The Company also provides prepaid program management services, primarily outside of the United States, that manage and enable switching and issuer processing for consumer and commercial prepaid travel cards for business partners, such as financial institutions, retailers, telecommunications companies, travel agents, foreign exchange bureaus, colleges and universities, airlines and governments.

- Micron Technology, Inc. [stckqut]MU[/stckqut]

- Micron Technology, Inc., incorporated on April 6, 1984, is engaged in semiconductor systems. The Company’s portfolio of memory technologies, including dynamic random-access memory (DRAM), negative-AND (NAND) Flash, and NOR Flash are the basis for solid-state drives, modules, multi-chip packages and other system solutions. Its business segments include Compute and Networking Business Unit (CNBU), which includes memory products sold into compute, networking, graphics and cloud server markets; Mobile Business Unit (MBU), which includes memory products sold into smartphone, tablet and other mobile-device markets; Storage Business Unit (SBU), which includes memory products sold into enterprise, client, cloud and removable storage markets, and SBU also includes products sold to Intel through its Intel/Micron Flash Technology (IMFT) joint venture, and Embedded Business Unit (EBU), which includes memory products sold into automotive, industrial, connected home and consumer electronics markets. The Company’s memory solutions enable computing, consumer, enterprise storage, networking, mobile, embedded and automotive applications. The Company markets its products through internal sales force, independent sales representatives and distributors primarily to original equipment manufacturers (OEMs) and retailers located around the world.

- Netflix, Inc. [stckqut]NFLX[/stckqut]

- Netflix, Inc., incorporated on August 29, 1997, is a provider an Internet television network. The Company operates through three segments: Domestic streaming, International streaming, and Domestic DVD. The Domestic streaming segment includes services that streams content to its members in the United States. The International streaming segment includes services that streams content to its members outside the United States. The Domestic DVD segment includes services, such as digital optical disc (DVD)-by-mail. The Company’s members can watch original series, documentaries, feature films, as well as television shows and movies directly on their Internet-connected screen, televisions, computers and mobile devices. It offers its streaming services both domestically and internationally. In the United States, its members can receive DVDs delivered to their homes. The Company had members streaming in over 190 countries, as of December 31, 2016. Its subsidiaries include Netflix Entretenimento Brasil LTDA, Netflix K.K., Netflix International B.V., Netflix Streaming Services, Inc., NetflixCS, Inc. and Netflix Studios, LLC.

- Insperity, Inc. [stckqut]NSP[/stckqut]

- Insperity, Inc. (Insperity), incorporated on August 9, 1995, provides a range of human resources (HR) and business solutions. The Company’s HR services offerings are provided through its Workforce Optimization and Workforce Synchronization solutions (together, its professional employer organization (PEO) HR Outsourcing solutions), which encompass a range of human resources functions, including payroll and employment administration, employee benefits, workers’ compensation, government compliance, performance management, and training and development services, along with its cloud-based human capital management platform, the Employee Service Center (ESC). In addition to its PEO HR Outsourcing solutions, the Company offers various other business performance solutions, including Human Capital Management, Payroll Services, Time and Attendance, Performance Management, Organizational Planning, Recruiting Services, Employment Screening, Financial and Expense Management Services, Retirement Services and Insurance Services, which are offered through desktop applications and cloud-based delivery models. These other products and services are offered separately, along with its PEO HR Outsourcing solutions or as a bundle, such as its Workforce Administration solution that provides a human capital management and payroll service solution.

- NVIDIA Corporation [stckqut]NVDA[/stckqut]

- Nvidia Corporation, incorporated on February 24, 1998, focuses on personal computer (PC) graphics, graphics processing unit (GPU) and also on artificial intelligence (AI). The Company provides service to its customers through PC, mobile and cloud architectures. The Company operates through two segments: GPU and Tegra Processor, which are based on a single underlying architecture. The Company’s processor has created platforms that address four markets: Gaming, Professional Visualization, Datacenter, and Automotive. The Company’s GPU product brands are aimed at specialized markets, including GeForce for gamers; Quadro for designers; Tesla and DGX for AI data scientists and big data researchers, and GRID for cloud-based visual computing users. The Company’s Tegra brand integrates an entire computer onto a single chip, and incorporates GPUs and multi-core central processing units (CPUs) to drive supercomputing for mobile gaming and entertainment devices, as well as autonomous robots, drones and cars.

- TriNet Group Inc [stckqut]TNET[/stckqut]

- TriNet Group, Inc. (TriNet), incorporated on January 26, 2000, is a provider of human resources (HR) solutions for small to medium-sized businesses (SMBs). The Company’s HR solutions include services, such as multi-state payroll processing and tax administration, employee benefits programs, including health insurance and retirement plans, workers’ compensation insurance and claims management, employment and benefit law compliance, and other services. The Company provides an HR technology platform with online and mobile tools that allow its clients and their worksite employees (WSEs) to store, view and manage their HR-related information and conducts a range of HR-related transactions anytime and anywhere. The Company’s clients are distributed across a range of industries, including technology, life sciences, not-for-profit, professional services, financial services, property management, retail, manufacturing, and hospitality.

- WellCare Health Plans, Inc. [stckqut]WCG[/stckqut]

- WellCare Health Plans, Inc., incorporated on February 5, 2004, is a managed care company. The Company focuses on government-sponsored managed care services, primarily through Medicaid, Medicare Advantage (MA) and Medicare Prescription Drug Plans (PDPs), to families, children, seniors and individuals with medical needs. The Company operates in three segments: Medicaid Health Plans, Medicare Health Plans, and Medicare PDPs. As of December 31, 2016, it served approximately 3.9 million members in 50 states and the District of Columbia. As of December 31, 2016, it operated Medicaid health plans in Arizona, Florida, Georgia, Hawaii, Illinois, Kentucky, Missouri, New Jersey, New York and South Carolina. As of December 31, 2016, it offered MA coordinated care plans (CCPs) in certain counties in Arizona, Arkansas, California, Connecticut, Florida, Georgia, Hawaii, Illinois, Kentucky, Louisiana, Mississippi, New Jersey, New York, South Carolina, Tennessee and Texas. As of December 31, 2016, it also offered standalone Medicare PDPs in 50 states and the District of Columbia.

My typical disclaimer says that I may or may not have a holding of the stocks discussed in this article. This would be a bit misleading for this particular article. You can assume that I am currently invested in every one of these stocks at the time of this writing.

The glass globe image at the top of this article is courtesy of suphakit73 at FreeDigitalPhotos.net