Timing the market – it is what the professionals do therefore you should as well

I regularly tell people that they need to try and time the market to accelerate their investment income. This puts me at odds with many financial advisers.

However, most of those financial advisers have a vested interest in creating a steady stream of investments. They don’t want that regular and anticipated stream of investments to dry up or be diverted to other investment opportunities. So, while their advice to regularly invest is good advice, the advice to not vary your investment vehicles could be more self-servicing for them then is prudent.

The reality is that the best of the best investors regularly time their investments. They don’t invest when the price is high and they heavily invest when low price opportunities are available to them.

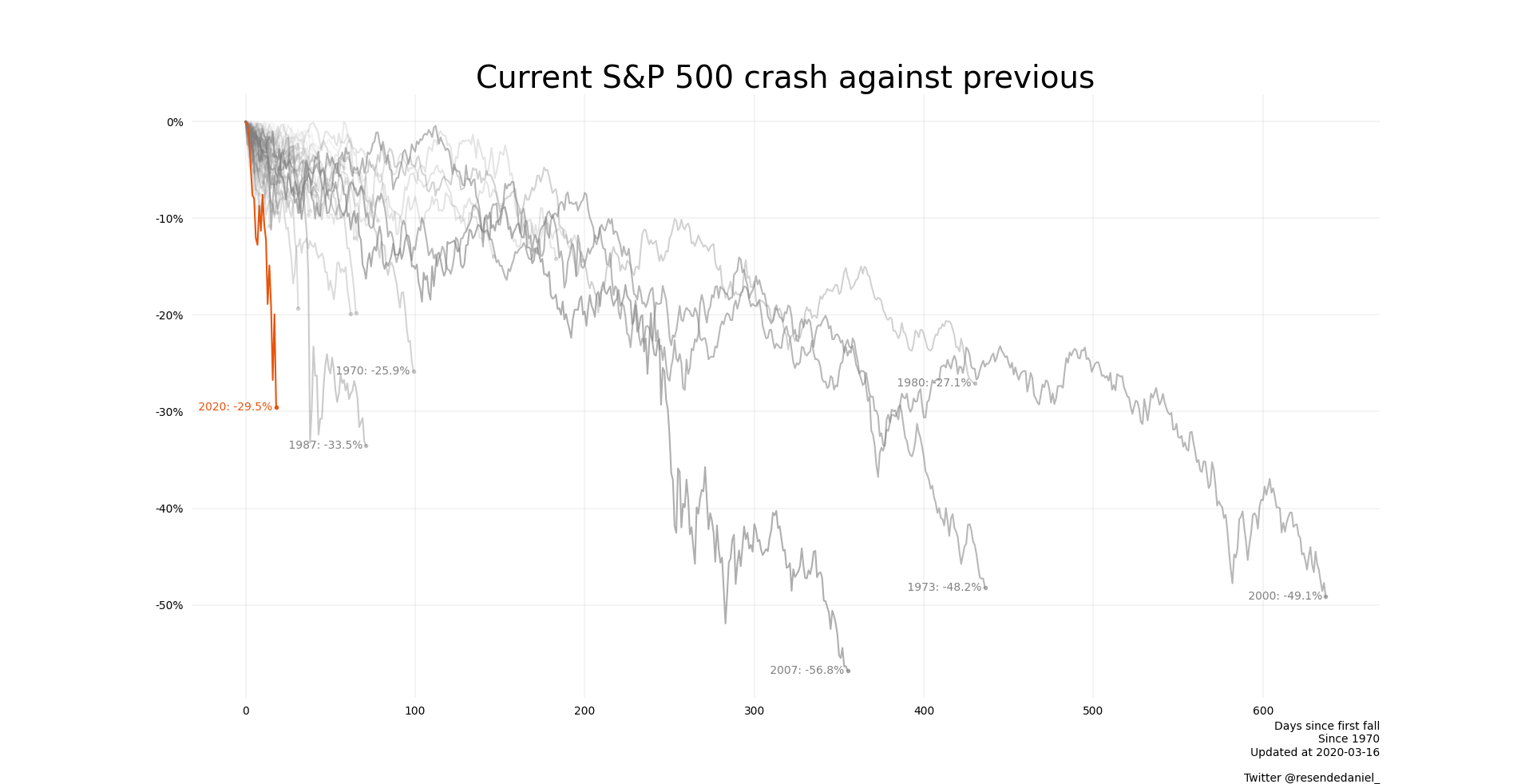

As I write this, we are a couple of weeks into a fairly major drop in the stock market due to the coronavirus SARS-CoV-2 outbreak. I thought this article on Bloomberg.com was very revealing and it produced the following table:

| Buyer | Company | Money spent ($M) |

|---|---|---|

| Carl Icahn | Hertz, Newell | 120 |

| Carlos Slim | PBF Energy | 48 |

| Kelcy Warren | Energy Transfer | 91 |

| Rausing family | International Flavors & Fragrances |

317 |

| Reimann family | Keurig Dr Pepper | 200 |

| Tammy Hughes Gustavson, Bradley Hughes |

American Homes 4 Rent | 108 |

| Warren Buffett | Delta Air Lines | 45 |

Source: Regulatory filings

Note: Transactions made since Jan. 1. Includes purchases made by firms partially or fully controlled by the person, such as Buffett’s Berkshire Hathaway and Slim’s Inversora Carso.

If the biggest and most successful investors are timing the market, then doesn’t it make sense that you should as well?