People Over 50 Carrying More Debt

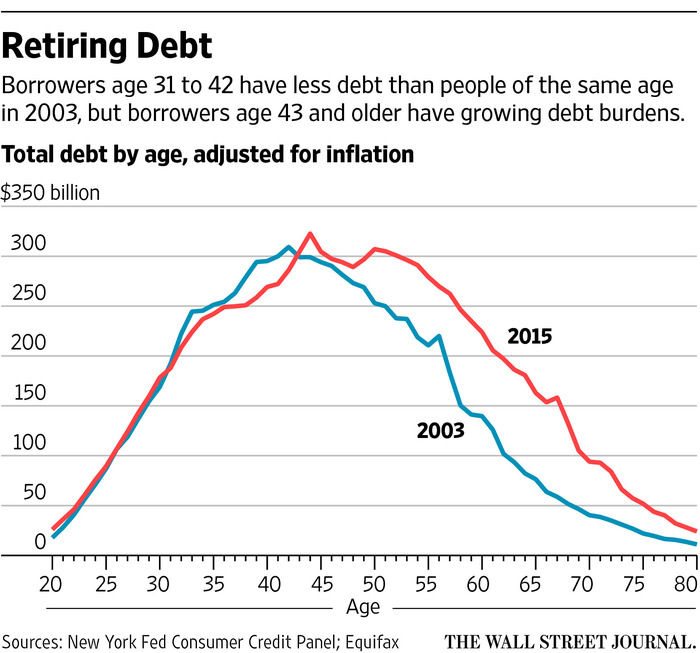

Older Americans are burdened with unprecedented debt loads as more and more baby boomers enter what are meant to be their retirement years owing far more on their houses, cars and even college loans than previous generations.

The average 65-year-old borrower has 47% more mortgage loans and 29% more auto loans than 65-year-olds had in 2003, after adjusting for inflation.

Just over a decade ago, student debt was unheard-of among 65-year-olds. Today it is a growing category, though it remains smaller for them than autos, credit cards and mortgages. On top of that, there are far more people in this age group than a decade ago.

The result: The composition of U.S. household debt is vastly different than it was before the financial crisis, when many younger households took on large debts they could no longer afford when the bottom fell out of the economy.

Older borrowers historically have been less likely to default on loans and typically have been successful at shrinking their balances. But greater borrowing among this age group could become alarming if evidence mounted that large numbers of people were entering retirement with debts they couldn’t manage. So far, that doesn’t appear to be the case. Most of the households with debt also have higher credit scores and more assets than in the past.

Source: People Over 50 Carrying More Debt Than in the Past – WSJ

![Dilbert bRaZiL by Ol.v!er [H2vPk] dilbert photo](http://confident-investor.com/wp-content/uploads/2014/09/178932650_078112c2c7_m_dilbert.jpg) In my opinion, Scott Adams is one of the great satirists of the 21st century. He frequently uses Dilbert to poke fun at companies, management, and the work force. In this strip, Scott is pointing out that the investment analysts that publish earnings expectations either don’t know what they are doing or are being “managed” by the company executive management.

In my opinion, Scott Adams is one of the great satirists of the 21st century. He frequently uses Dilbert to poke fun at companies, management, and the work force. In this strip, Scott is pointing out that the investment analysts that publish earnings expectations either don’t know what they are doing or are being “managed” by the company executive management.