Large Investors Turns to ETFs to Counteract Difficulties in Bond Market

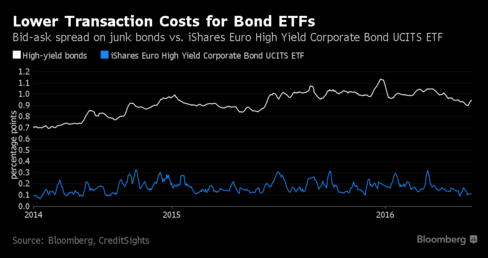

Investors are putting record amounts of money into exchange-traded funds as bonds become increasingly difficult to buy and sell.

Global fixed-income ETFs, which track bond indexes and trade like stocks, attracted $60 billion of inflows this year through May 25, according to data compiled by BlackRock Inc. That’s the most for the period since the funds were created 14 years ago and on pace to top last year’s record total of $93.5 billion.

The funds are emerging as one of the few winners from worsening trading conditions as dealers pull back from making markets and investors seek cheaper ways to take and hedge credit exposure. Liquidity and ease of use are the top reasons given by about 70 percent of bond ETF users, according to a report by Greenwich Associates.

Fixed-income ETFs manage about $576 billion of global assets, ranging from Treasuries to high-yield corporate bonds and emerging-market debt. BlackRock, the biggest provider of the funds, started Europe’s first ETF for mortgage-backed securities last month.

Source: Wall Street Turns to ETFs to Sidestep Illiquidity in Bond Market – Bloomberg

People Over 50 Carrying More Debt

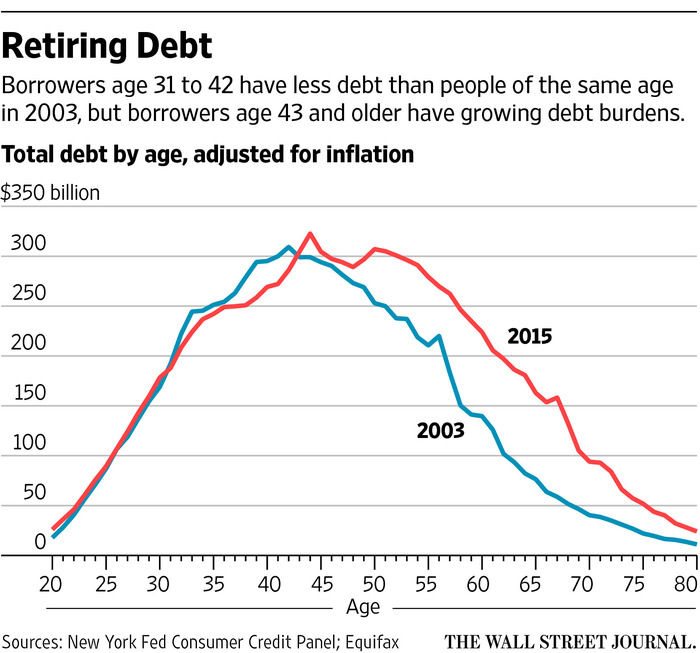

Older Americans are burdened with unprecedented debt loads as more and more baby boomers enter what are meant to be their retirement years owing far more on their houses, cars and even college loans than previous generations.

The average 65-year-old borrower has 47% more mortgage loans and 29% more auto loans than 65-year-olds had in 2003, after adjusting for inflation.

Just over a decade ago, student debt was unheard-of among 65-year-olds. Today it is a growing category, though it remains smaller for them than autos, credit cards and mortgages. On top of that, there are far more people in this age group than a decade ago.

The result: The composition of U.S. household debt is vastly different than it was before the financial crisis, when many younger households took on large debts they could no longer afford when the bottom fell out of the economy.

Older borrowers historically have been less likely to default on loans and typically have been successful at shrinking their balances. But greater borrowing among this age group could become alarming if evidence mounted that large numbers of people were entering retirement with debts they couldn’t manage. So far, that doesn’t appear to be the case. Most of the households with debt also have higher credit scores and more assets than in the past.

Source: People Over 50 Carrying More Debt Than in the Past – WSJ