Saving for Retirement? The Rulebook Is About to Change

New rules aimed at stockbrokers will have enormous impacts on the way Americans save for retirement.

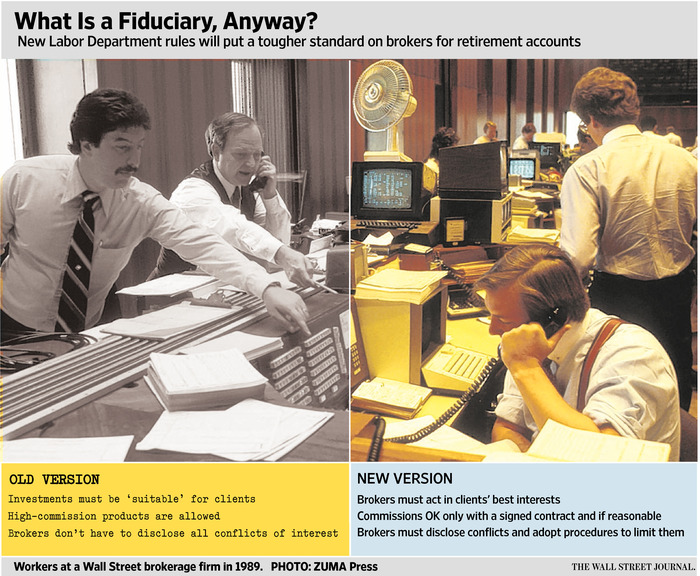

The rules aren’t coming from the government’s financial regulatory apparatus but from the Labor Department. The Labor Department is releasing final regulations that will require brokers getting paid to provide investment guidance on a retirement account to act solely in the best interest of the investor.

Brokers’ recommendations to this point have only had to be “suitable”—a less rigorous standard that critics say has encouraged some advisers to charge excessive fees, favor investments that offer hidden commissions and recommend securities that can be difficult for investors to sell.

The shift, more than six years in the making, could cut the total costs of investing by billions of dollars annually. But it also will put the federal government deeper into the business of deciding what Americans should do with their own money.

Investors who now pay commissions when they buy stocks or bonds will likely be moved into accounts where brokers collect up to 1% of their assets every year—a change that will compensate brokers for increasing the size of the account, not selling products. A range of popular but controversial offerings like variable annuities, commodity pools and some real estate investment trusts will likely be de-emphasized for retirement accounts. In their place investors increasingly will be offered low-cost index funds that passively mimic market returns. Moving funds from a 401(k) into an individual retirement account could become cheaper, as brokers comply with requirements that the fees are reasonable and the investment strategy is appropriate. And investors who feel they were wronged will find it easier to sue for breach of contract.

The flip side of those changes is that the money-management industry faces its most sweeping overhaul in a generation. Small firms could be heavily pressured by compliance costs, while some large financial firms could be left better off than before.

Mountains of money hang in the balance. Total assets held in IRAs stood at $7.3 trillion at the end of 2015, an amount roughly equal to the combined gross domestic product of Germany and Japan. An additional $6.7 trillion sits in 401(k)s and similar employer-sponsored retirement plans, estimates the Investment Company Institute, a trade group for fund managers.

Changes aimed at how that money is managed could easily spread into the broader market for financial advice.

This will have a sweeping impact. The Labor Department’s new rules on retirement-account advice will touch large numbers of American savers and financial companies.

New rules will affect:

- 21 million retirement plans and IRAs

- 2,800 financial firms

To comply financial institutions will have to produce about 86 million written disclosures and notices in the first year with an estimated cost of $69 million

Source: Saving for Retirement? The Rulebook Is About to Change – WSJ

Think What You Could Do With Half a Million Dollars in Retirement

If you ever needed motivation to save money for your own retirement, consider the cost of health care and the massive bite it will take out of your Social Security check.

The projected tab for an average, healthy 65-year-old couple retiring this year, in lifetime premiums for Medicare Parts B and D and supplemental insurance, is $288,000. Add in out-of-pocket expenses, including dental, hearing, and vision care, and the bill reaches $377,412.

A 65-year-old couple retiring this year would need 57 percent of their Social Security payments just to cover their health-care expenses. For a couple 10 years younger, with plans to retire in 2026, that jumps to 88 percent. For a 45-year-old couple, it’s 116 percent.

From 2015 to 2016, retirement health-care costs are projected to jump 7.3 percent.

A 30-year-old woman who retires at 65 will face about $119,000 more in expenses than her male counterpart, the report forecasts. That’s based on women living until age 91 and men living until 87. The figures, in today’s dollars, are $548,098 for women and $429,466 for men.

Source: Think What You Could Do With Half a Million Dollars in Retirement – Bloomberg