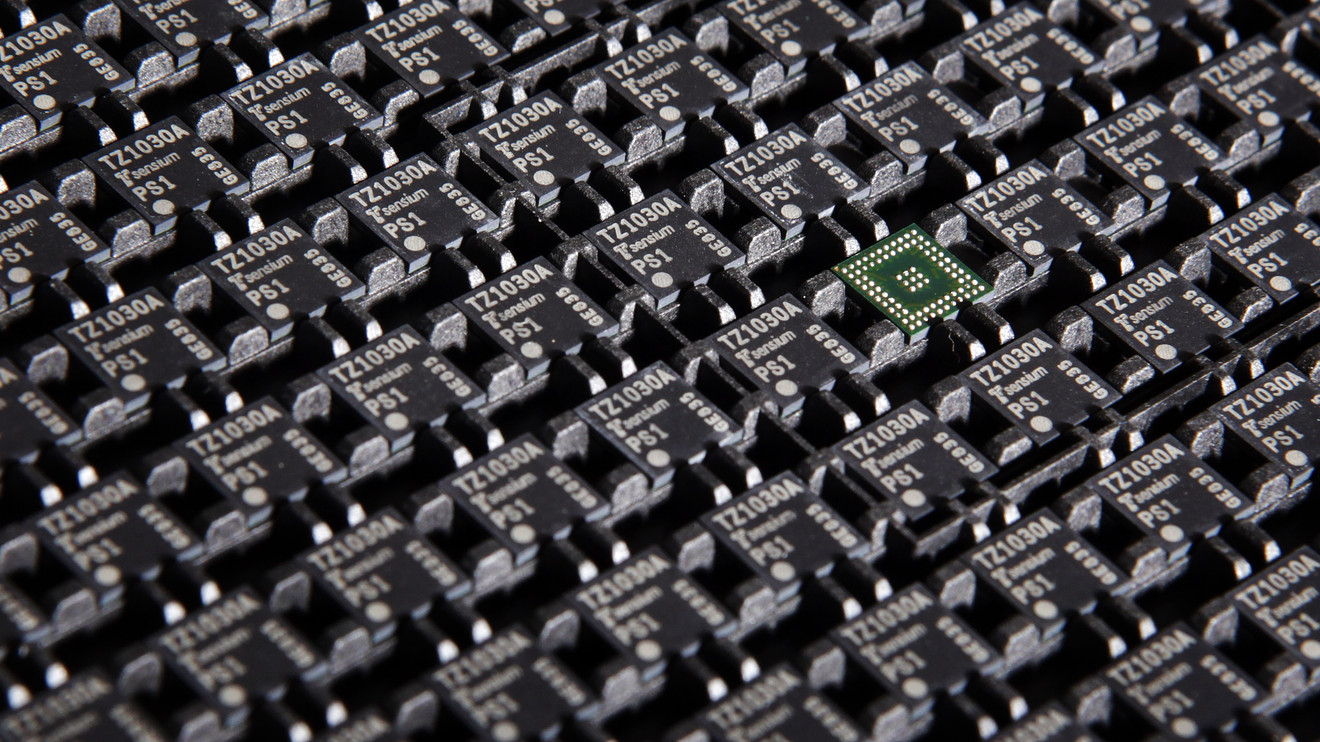

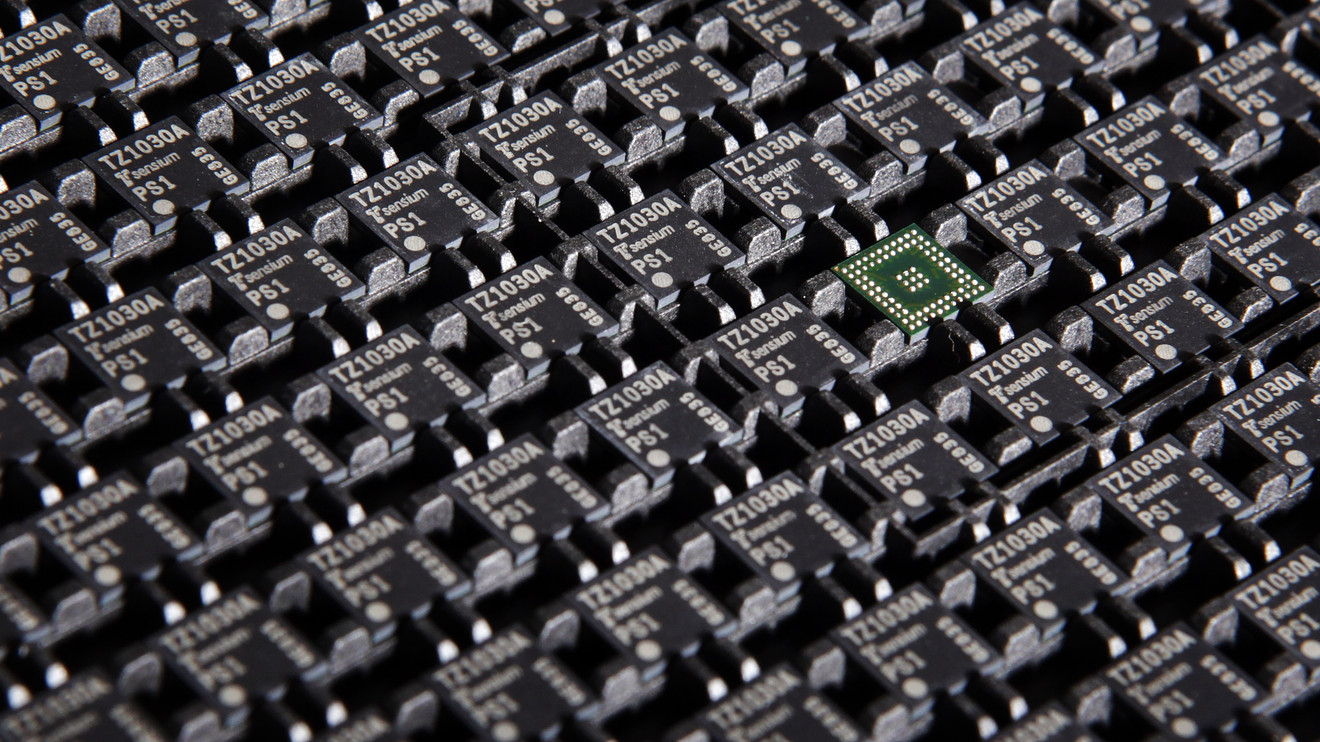

Chip merger frenzy continues with Lam ($LCRX) purchase of KLA-Tencor ($KLAC)

Lam Research Corp. [stckqut]LCRX[/stckqut] on Wednesday announced a deal to buy KLA-Tencor Corp. [stckqut]KLAC[/stckqut] for $10.6 billion, the latest sign that consolidation pressures among chip makers have spread to their suppliers.

The two Silicon Valley companies rank among the biggest makers of equipment used in semiconductor manufacturing. Lam has focused on machines that deposit or etch away materials on the silicon wafers used to make computer chips. KLA-Tencor’s machines, by contrast, are used to spot defects in chips once the wafers are processed.

Such equipment makers have long been whipsawed by boom and bust cycles, as chip makers boost or cut back manufacturing capacity in response to demand. Acquisitions have been common over the years, as companies try to assemble a broader list of machines to sell customers.

Source: Chip merger frenzy continues with Lam purchase of KLA-Tencor