Review of Investment Sites for Quick Analysis (Part 1 of 2)

I regularly get asked what tools that I use to analyze stocks. I am going to write about these tools in a series of posts. I want to clarify that I am not saying negative things about other sites and tools. In fact, I am sure that other tools can provide similar benefits and features.

When I first look at a company, I use two tools: MSN Money and Google Finance. I find that I can understand most of what I need to look quickly at a company with these two tools. I will first focus on Google Finance, and in a subsequent post, I will explore MSN Money.

I usually receive requests via Twitter (follow me @ConfidentInvest) or the contact form on this site. The request is usually something like, "What do you think of XYZ?" My first step when someone asks me about an unfamiliar company is to go to Google Finance. I can quickly determine the company’s profitability, the major competitors, and then review recent news that is affecting the stock.

If you have read my site for any length of time, you will notice that the company must be profitable if I am going to invest. This is extremely obvious at the top of the Google Finance screen. If the company is not profitable, then I am done. I reply to the inquiring individual not to invest in unprofitable companies because it is extremely difficult to be confident in their actions.

I set the trading history on the stock chart to 3 months on my first review. My goal is to determine the dividend history. I also check out some of the articles that may be relevant to the company. This only takes a few minutes, but it allows me to see if there is any news about the company that may be influencing price moves. Also, since my site is called Confident Investor, a 3 month history will give me some idea of the volatility of the stock.

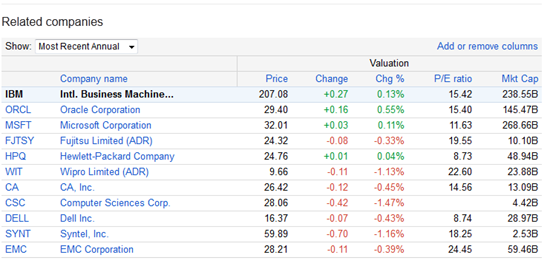

I then scroll down to the competitors. Do I know any of them? If I already invest in one of the competitors, I can do a comparison of the two stock histories. This gives me an idea if this new company is a better investment than the original company. I also do a quick comparison of the P/E between the competitors. If it is not in line, there may be a problem. If the P/E is too high compared to its competitors, I will need to figure out why investors pay a premium for this company. If the P/E is too low, why are they punishing the company? P/E is a excellent indicator to see if investors like or dislike a company.

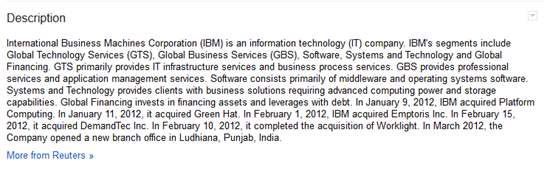

Finally, I do a quick read of the Description of the company. I usually know what the company does , but this quick read confirms it.

This is my first review of the company. At this point, I may be able to inform the inquirer if I dislike the company , but I cannot tell if I like the company. To do that, I need to go to MSN Money – I will review that tool in a later post. Stay tuned.

If you want to be warned when I post about MSN Money, there are several straightforward ways to do this. You can subscribe to my feed in your news reader. You can also sign up for my weekly newsletter which will give you the articles for the week. Finally, you can subscribe to my Twitter account @ConfidentInvest.