Start investing now so that you can retire

Those who are saving won’t have nearly enough. The average 50-year-old, for example, has just $43,797 saved up for retirement. That won’t go very far, as the projected medical treatment costs alone for a couple over 65 with an average 20-year retirement are expected to reach $215,000. With statistics like that, most Americans will struggle just to make ends meet in their retirement.

Those who are saving won’t have nearly enough. The average 50-year-old, for example, has just $43,797 saved up for retirement. That won’t go very far, as the projected medical treatment costs alone for a couple over 65 with an average 20-year retirement are expected to reach $215,000. With statistics like that, most Americans will struggle just to make ends meet in their retirement.

Despite these alarming numbers, it’s quite easy to comfortably retire in America. In fact, by following three simple steps, many Americans can not only retire eventually, but maybe even retire early.

Stop wasting money so that you can retire!

Credit card interest really adds up. For example, the average American carries nearly $4,878 in credit card debt, while the average APR on a credit card with a balance is 12.73%. That means that the average American is forking over $620.95 per year in credit card interest payments alone.

It must be a top priority to pay off your credit card balance as soon as possible. After it is paid off, avoid carrying a credit card balance in the future except in emergencies. This effort will free up hundreds of dollars each year that could be invested and earning interest for an early retirement instead of earning interest for the credit card company.

Live by the simple rule, do I need to spend the money or is there a way for me to not spend the money. This leads us to the next topic.

Live below your means so that you can retire

It goes without saying, but anyone who hopes to retire needs to spend less than they make.

The first step is knowing what comes in and what goes out. Tracking software like Quicken or Mint.com, or even an Excel spreadsheet, is a must. From there it will be easier to determine where too much money is being spent.

Then comes the hard part: determining where to make cuts. It could mean cutting the cord on cable and relying on cheaper entertainment options. Perhaps you should pack a lunch for work instead of buying lunch. It might even mean not upgrading smartphones each time a new model comes out or holding on to the car for one more year.

Then there are the superfluous purchases we make without realizing the cost. For example, ordering soda or alcohol at a restaurant can cost us anywhere from a couple of bucks to $10-15, but water is free. Avoiding these purchases except on special occasions can add up to big savings over time.

For example, one $2.50 drink purchase each week adds up to $130 over the course of a year. If that money were invested in a tax-deferred retirement account earning 7% per year, it would add up to more than $13,000 after 30 years. That’s just one of many ways to save money so you can enjoy a better retirement.

Living below your means isn’t about depriving yourself and living on Ramen noodles. It’s about having enough margin in your budget that you don’t live from paycheck to paycheck, and you have money left over to put toward retirement.

Invest the excess so that you can retire in luxury

You can only get so far on the road to early retirement by slashing costs. At some point, you need to put these savings to work. That’s where investing comes into play.

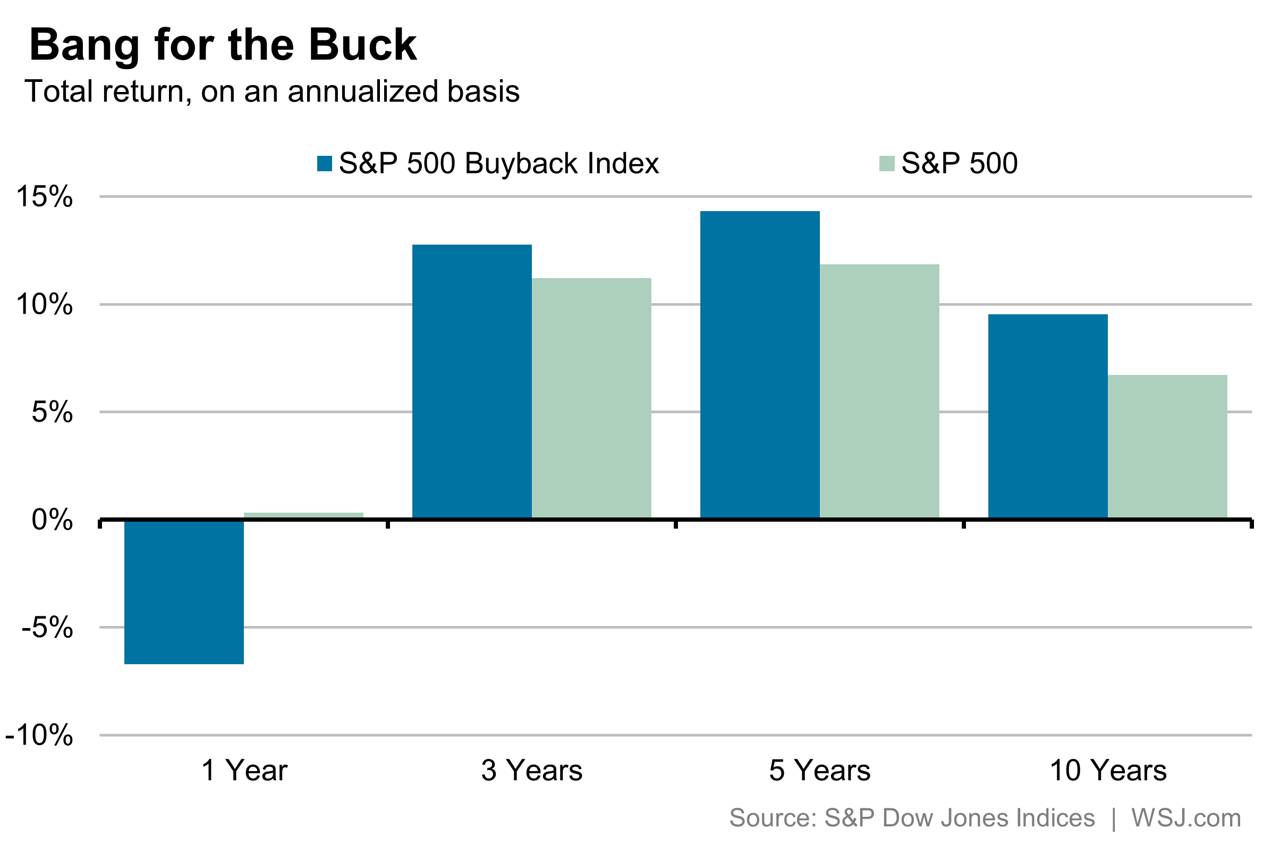

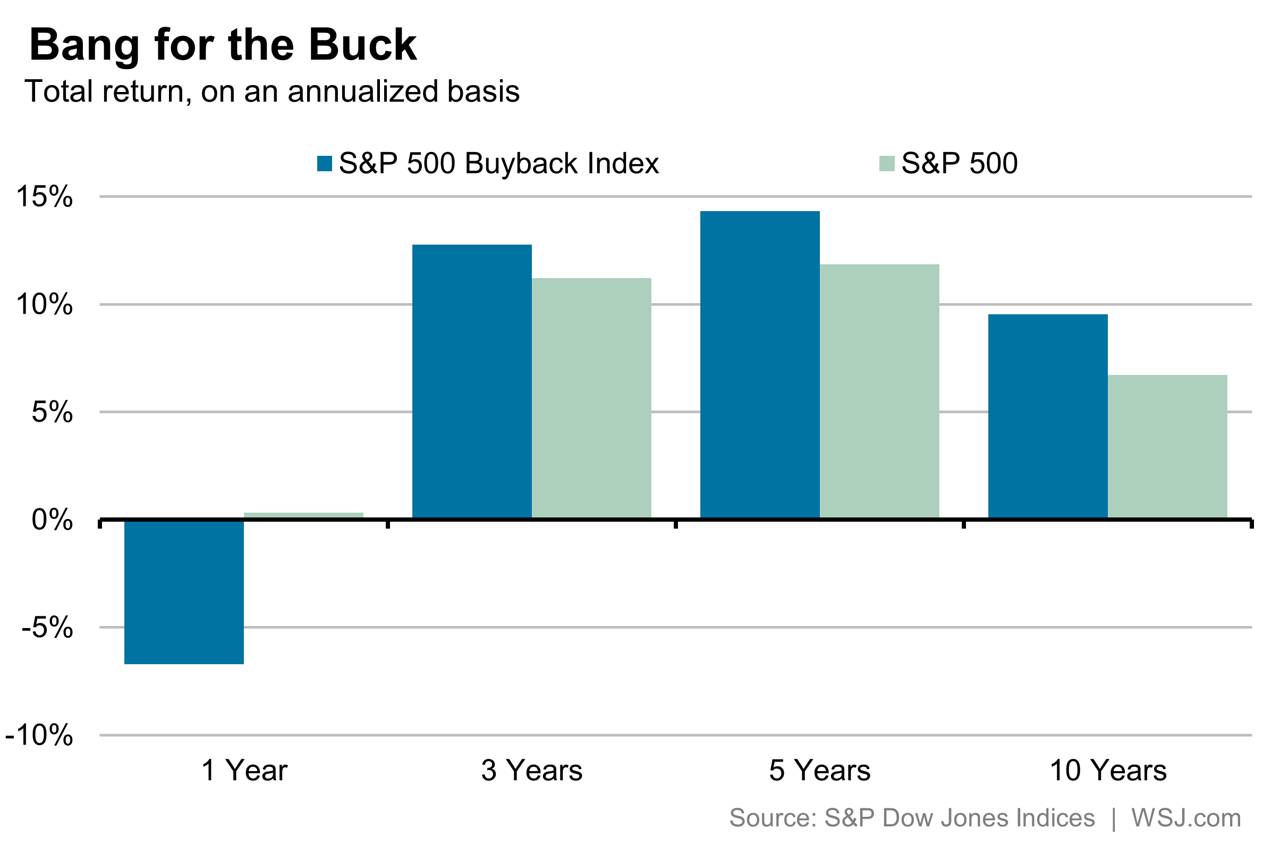

Start putting that saved money into an index fund tied to the S&P500. Once you have invested about $10,000 in that index fund, you should start to break up your portfolio to being 35% index funds and 65% direct investments in great companies. I publish a list of great companies on this site – it is my Watch List.

As you build up your portfolio, you will want to learn how to make your money work even harder than just an index fund. I suggest reading my book, The Confident Investor. You can purchase my book wherever books are sold such as Amazon, Barnes and Noble, and Books A Million. It is available in e-book formats for Nook, Kindle, and iPad.

You should also download and read my Retire in Luxury whitepaper.

Photo by 401(K) 2013