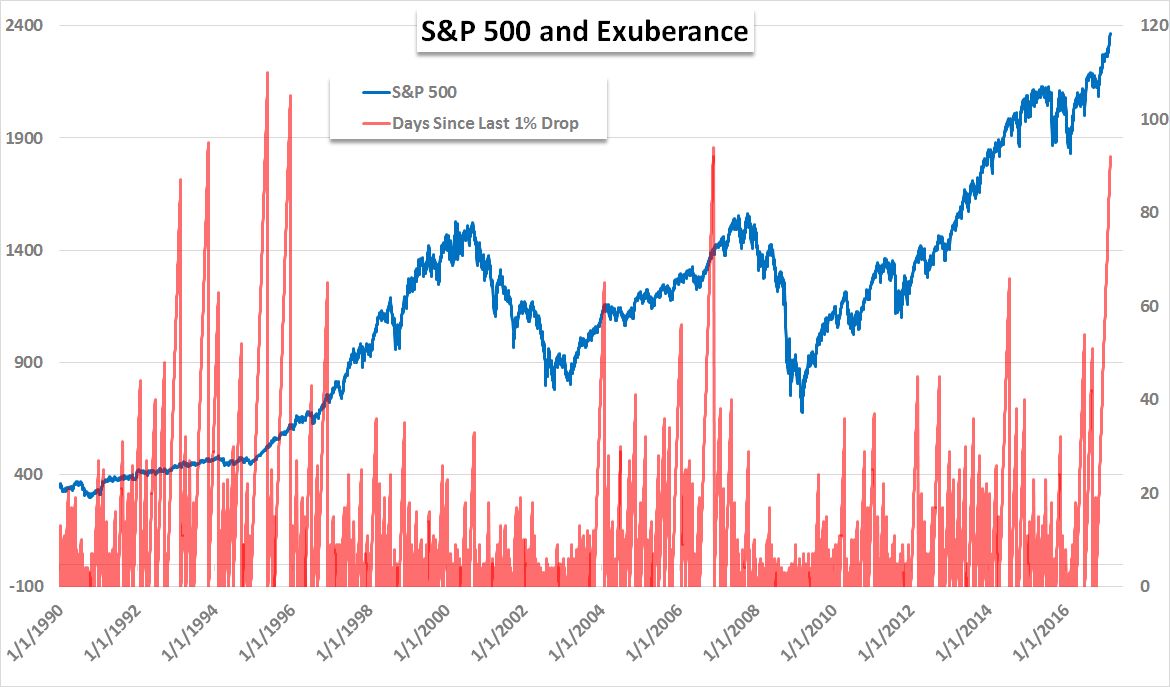

As John Kicklighter points out on Stocktwits (https://stocktwits.com/johnkicklighter), we have now have had 92 straight trading days since the S&P500 has had a 1% loss.

The gains also have been broad-based, with sectors such as financials, consumer goods, technology, and healthcare all advancing. At least four major factors are helping drive prices higher: rising corporate earnings, global economic growth, continued low-interest rates and expectations that President Trump’s call for tax and regulatory cuts could further swell earnings.

It’s worth keeping historical data in your decision-making arsenal. The average bull-market length is 54 months, according to J.P. Morgan Asset Management—42 months shorter than the current bull run through February. And the S&P 500 long-term average price/earnings ratio? It’s just 15, compared with more than 25 today. That kind of wider context signals that today’s valuations and recent good times won’t be easy to sustain.

Source: johnkicklighter – Now 92 trading days since we had a 1% or greater loss from t… | StockTwits