NVIDIA Corporation [stckqut]NVDA[/stckqut] isn’t going anywhere. In fact, as the CEO said in the latest earnings call, it is the fastest growing technology company in the world. But there’s more to that statement — a lot more.

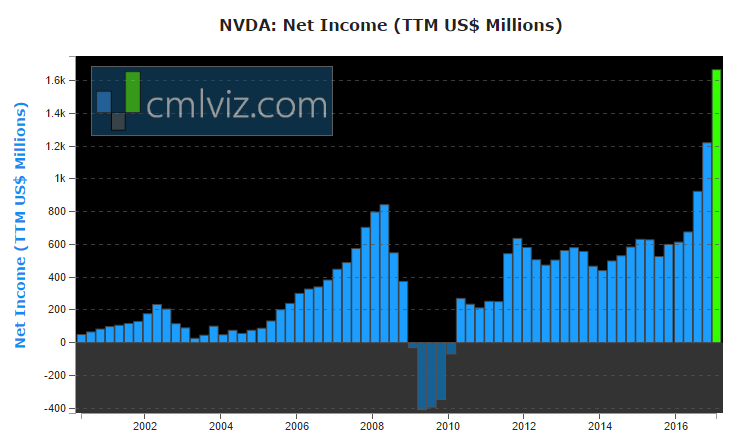

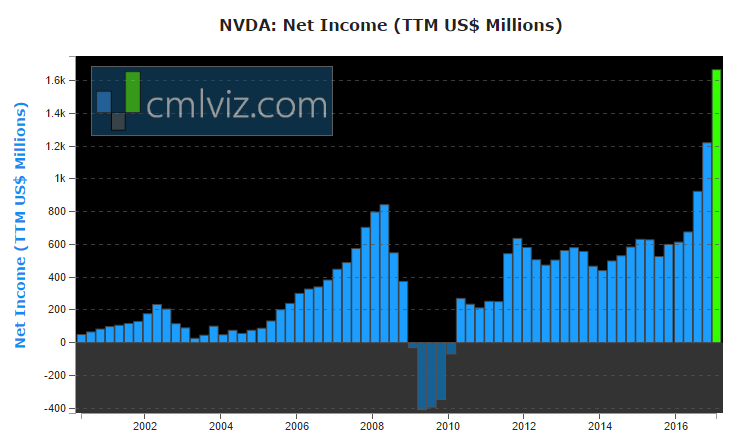

First, when we talk about growth here, sometimes we reflect upon companies where growth is coming while earnings are forsaken. That is not the case at all with Nvidia.

NVIDIA Corporation has hit $6.9 billion in revenue, up 38% year-over-year. But, this gets much bigger. These are numbers for the last quarter, compared the same quarter one year ago:

- Gaming revenue was $1.35 billion up from $810 million for 66% growth.

- Data center revenue was $296 million up from $97 million for 205% growth.

- Automotive revenue was $128 million up from $93 million for 38% growth.

Amazon and Microsoft, the two largest cloud players, openly offer Nvidia GPU powered machines to their clients, and the conversion so barely (barely) at the beginning.

In just the last quarter, Nvidia announced:

- Collaborated with Microsoft to accelerate AI with a GPU-accelerated Microsoft Cognitive Toolkit available on the Microsoft Azure cloud and NVIDIA DGX-1™.

- Partnered with the National Cancer Institute and the U.S. Department of Energy to build CANDLE, an AI framework that will advance cancer research.

- Unveiled the NVIDIA DGX SATURNV AI supercomputer, powered by 124 Pascal-powered DGX-1 server nodes, which is the world’s most efficient supercomputer.

- Partnered with Audi, to put advanced AI cars on the road by 2020.

- Partnered with Mercedes-Benz, to bring a NVIDIA AI-powered car to the market.

- Partnered with Bosch, the world’s largest automotive supplier, to bring self-driving systems to production vehicles

- Partnered with Germany’s ZF, to create a self-driving system for cars, trucks and commercial vehicles based on the NVIDIA DRIVE™ PX 2 AI car computer.

- Partnered with Europe’s HERE, to develop HERE HD Live Map into a real-time, high-definition mapping solution for autonomous vehicles.

- Partnered with Japan’s ZENRIN, to develop a cloud-to-car HD map solution for self-driving cars.

Barron’s notes that the firm provides processors to more than 50 automakers working toward driver-less cars.

Nvidia’s net income was $1.67 billion in the last year, up 171% year-over-year. For perspective, Amazon’s net income over the last year was $2.4 billion.

Here are some more facts for you to consider, whichever direction you go with Nvidia. This is last quarter’s earnings results highlights:

- Growth was driven primarily by Datacenter tripling with a rapid adoption of AI worldwide.

- AI is transforming industries worldwide. The first adopters were hyperscale companies like Microsoft, Facebook, and Google, which use deep learning to provide billions to customers with AI services that utilize image recognition and voice processing.

The next area of growth will occur as enterprises in such fields as healthcare, retail, transportation, and finance embrace deep learning on GPUs.

- Microsoft announced that its GPU-accelerated Microsoft Cognitive Toolkit is available both in Azure cloud and on premises with our DGX-1 AI supercomputer

- Growth for the quarter and fiscal year was broad based with record revenue in each of our four platforms, Gaming, Professional Visualization, Datacenter and Automotive.

- Q4 Gaming revenue was a record $1.35 billion, rising 66% year-on-year and up 8% from Q3

- GRID, graphics, virtualization business doubled year-on-year, driven by strong growth in the education, automotive, and energy sectors.

- With NVIDIAs powering the market’s only self-driving cars and partnerships with leading automakers, Tier 1 suppliers, and mapping companies, we feel very confident in our position as the transportation industry moves to autonomous vehicles.

- Gross margins were at record levels.

- GAAP operating income was $733 million, and non-GAAP operating income was $809 million, both more than doubled from a year earlier.