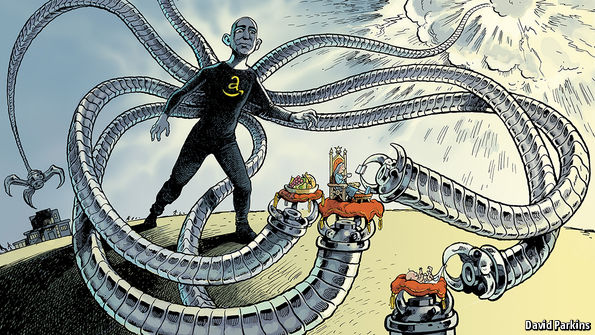

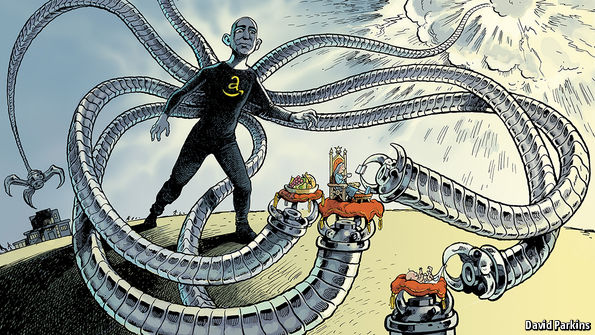

EVERY chief executive hopes to lead his company to success. Jeff Bezos, Amazon’s boss [stckqut]AMZN[/stckqut], wants something more epic. A prominent wall in the company’s headquarters in Seattle is covered with narratives from historic explorations: excerpts from “The Odyssey”; notes from the journey of Lewis and Clark as they ventured across America; the transcript of the first moon-walkers talking to mission control. At the end, ones and zeroes spell out how far the company has got: “Day One”.

The phrase, reflecting Mr Bezos’s belief that Amazon’s journey has just begun—and begins again each day—is the company’s mantra. At any other firm such grandiosity would invite derision. At Amazon, it makes investors drool and rivals quake.

Amazon, which went public 20 years ago, is now the world’s fifth-largest company by value, worth over $400bn (see chart).

Its e-commerce site accounts for about 5% of retail spending in America, roughly half the share of Walmart, the biggest firm in the sector. It is the biggest online retailer in America, and accounts for over half of all new spending. Its cloud-computing business, Amazon Web Services (AWS), is larger in terms of basic computing services than the three closest competing cloud offerings combined.

Since the start of 2015 Amazon’s share price has risen by 173%, seven times the growth of the preceding two years. Operating profits have expanded, too, but at $4.2bn remain relatively small—which is how shareholders like it. Amazon has always emphasised the value of long-term growth (presumably with some bigger profits down the line), and investors have come to accept this. In February, when Amazon reported higher profits but lower revenue than expected, its share price temporarily dipped. Shareholders worried it might not be set to grow as quickly as they had hoped.

Morgan Stanley, a bank, expects Amazon’s sales to rise by a compound average of 16% each year from 2016 through to 2025: that is higher than its estimates for Google or Facebook. That is a slower pace than Amazon managed over the past decade; but the bigger a company is, the harder it is to keep growing. Amazon’s annual sales of $136bn are almost 50% more than those of Alphabet, Google’s parent, and over four times Facebook’s. Credit Suisse, another bank, calculates that only ten firms with sales of more than $50bn have managed to grow by an average of 15% or more for ten years straight since 1950; no company with sales of more than $100bn has done so. If Amazon were to pull it off, it would be the most aggressive expansion of a giant company in the history of modern business.

Source: Primed: Are investors too optimistic about Amazon? | The Economist