Apple ($AAPL) Ordered to Pay $234 Million in Patent Lawsuit

A federal jury Friday ordered Apple Inc. [stckqut]AAPL[/stckqut] to pay the University of Wisconsin $234 million for illegally using the university’s technology in processors that power some iPhones and iPads, a setback for the company in one of several ongoing battles over the technology behind its smartphones.

The jury in U.S. District Court in Madison, Wis., ruled Tuesday that some recent Apple devices infringed the university’s 1998 patent on improving processor efficiency.

Source: Apple Ordered to Pay $234 Million in Patent Lawsuit – WSJ

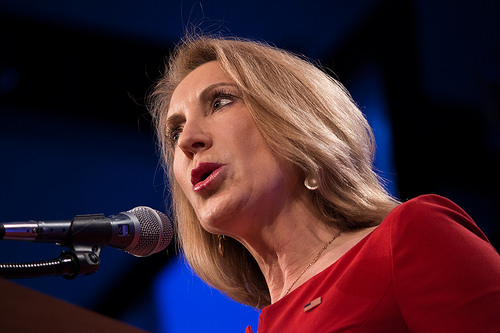

Carly Fiorina is currently a candidate for President of the United States of America. She is campaigning for the nomination of the Republican Party to run in the general election of 2016. According to her, one of her strengths is her business background. Most notable she speaks of her background as the first CEO of a DOW30 company: Hewlett-Packard [stckqut]HPQ[/stckqut].

Carly Fiorina is currently a candidate for President of the United States of America. She is campaigning for the nomination of the Republican Party to run in the general election of 2016. According to her, one of her strengths is her business background. Most notable she speaks of her background as the first CEO of a DOW30 company: Hewlett-Packard [stckqut]HPQ[/stckqut]. Ironically, her record at HP is one of the criticisms of Ms. Fiorina. Donald Trump is famous for criticizing her as a failed CEO, and he often cites

Ironically, her record at HP is one of the criticisms of Ms. Fiorina. Donald Trump is famous for criticizing her as a failed CEO, and he often cites