I recently discussed how I use Google Finance to do part of my "quick" analysis of a stock when a reader asks my advice. Typically, I receive these requests from Twitter (@ConfidentInvest) or via the Contact Me on this site. After I do the quick review of a company on Google Finance, I need to dig in a bit more before I give an opinion on the stock. Most of that work, I do on MSN Money.

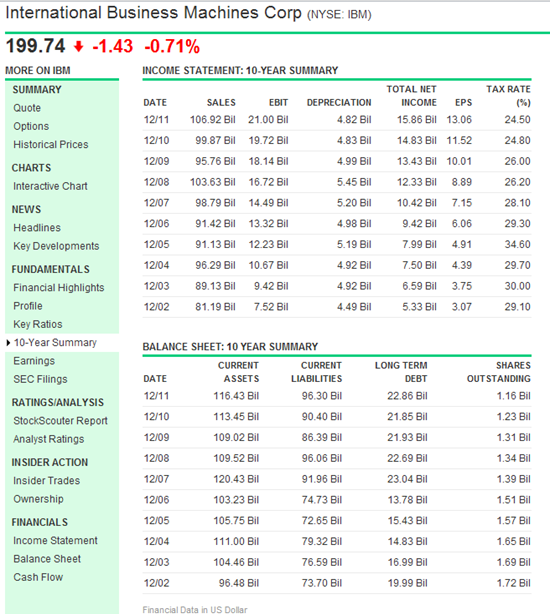

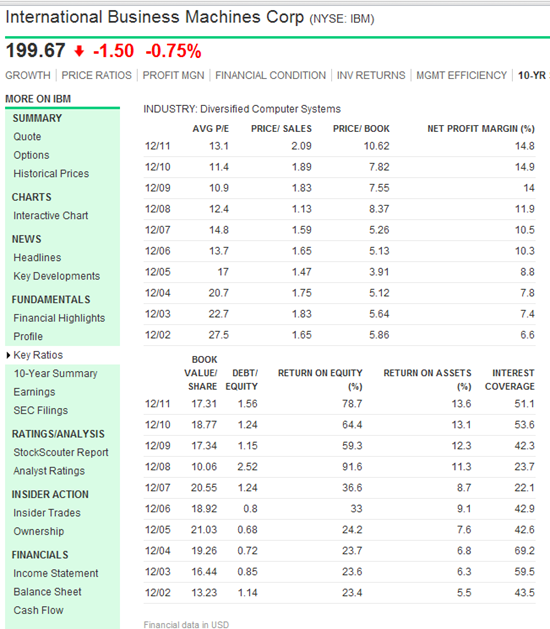

As you can tell by the metrics I report in my analysis reports, I worry about the 10 year growth history of 4 major metrics:

- P/E

- EBIT

- Sales

- Profit

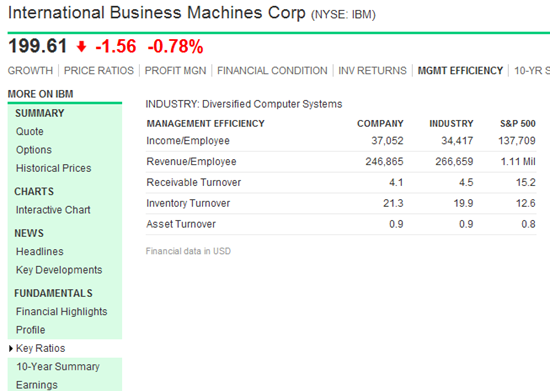

I also look at the ability of a company’s managers to manage their revenue and profitability as a function of the number of employees.

To find the 10 year history, go to 10-Year Summary on the left side of the page. Also go to Key Ratios and further select 10-YEAR SUMMARY across the top of that page. When I do a full analysis for my site, I enter these values into a spreadsheet and perform trend analysis that closely models the rate of growth. I call this deep analysis TWCA and will explain more about that technique in the future. However, for a quick response to a reader’s question, I will do a mental calculation that the values are growing at a fairly even pace over the past decade. My concern is a major change in the numbers (especially negative growth). If the growth is relatively consistent, then I assume that a Confident Investor can cautiously invest in the company.

I then quickly look at the revenue per employee and then income per employee. This is found in the Key Ratios section but under MGMT EFFICIENCY on the top. I want to compare these numbers to the averages in the specific industry as well as to the S&P500. Companies that have too little revenue or profit per employee may be out of control and be heading into a rough time. This isn’t an albatross, but it does give me some concerns. For instance, in the screen shot above, IBM is significantly lower than the industry as well as the S&P 500.

At this point, I can answer the inquisitor. On an email or Twitter response, it is usually not very definitive. For a quick look, I haven’t done the math to rate the stock as a Good Company, Fair Company or Poor Company. However, if my quick look is interesting, I will add it to my list of stocks to spend more time with and perhaps create an analysis here.

When I find a company that I like and have on my Watch List, I use my account on Fidelity to manage my investment. I am very open on my Disclaimer page that you can expect that I personally invest in companies that I find attractive. Other brokerage houses have similar tools that I am sure are quite good, but I really like Fidelity’s tools. In a future post, I will write about what I do there. If you want to make sure that you don’t miss my posts, please follow me on Twitter (@ConfidentInvest), subscribe to the RSS feed of this site, or subscribe to the weekly digest email that is sent out on Monday.