The beginning of the year is when it seems like every financial website puts out its top or worst stocks. In that vein, I offer my 15 recommended stocks for 2014 – or at least the first half of the year. I cannot list the worst stocks, as there are too many of those to list. I can at least list the 15 recommended stocks that will give you a good basis for the first half of 2014.

The beginning of the year is when it seems like every financial website puts out its top or worst stocks. In that vein, I offer my 15 recommended stocks for 2014 – or at least the first half of the year. I cannot list the worst stocks, as there are too many of those to list. I can at least list the 15 recommended stocks that will give you a good basis for the first half of 2014.

Many sites do all year lists, but I am only committing to this list for the first 6 months. There is a great reason for this. It is almost impossible to predict the market farther out than 6 month. In fact, it is quite possible for the market to do a massive correction and even this list would be a fallacy. There is always some risk with any investment and you are encouraged to read this site’s disclaimer before acting on this list.

I would expect all of these companies to maintain their status as Good Companies on my Watch List. I would not expect all of them to make a top 15 recommended stocks list at the end of June. Some of them will grow a bit slower than I expect, and a couple of the 15 recommended stocks are probably going to lose money. As Peter Lynch famously said:

“In this business if you’re good, you’re right six times out of ten. You’re never going to be right nine times out of ten.”

By Peter’s standards, I hope to right on this list with 9 of these picks. I don’t expect all 15 recommended stocks to be massive growth stocks in the year. I also think the list is successful if the list of 15 beats the S&P 500 and the Dow30. In July, perhaps I will publish a list for the second half of the year.

If we would go back in time (starting from December 1) and buy the 15 recommended stocks 3 years ago our portfolio would have grown very nicely. These stocks would have appreciated by 73.35% year over year. They would have grown 184.79% over the last three years. These stocks would have beaten the market (as measured by the Dow Jones Industrial Average) for the last three years by 330.57%. In the past year, these stocks would have beaten the market by 212.17%. With that track record, we should expect good results in the next 6 months.

All of the stocks on this list are rated as Good Companies using the method that I describe in my book The Confident Investor. You can purchase my book wherever books are sold such as Amazon, Barnes and Noble, and Books A Million. It is available in e-book formats for Nook, Kindle, and iPad.

The 15 recommended stocks were chosen from Good Companies on my Watch List. This means we already know they are fairly well managed and have a history of solid growth. While all of the stocks on the Watch List are Good Companies, these 15 recommended stocks seem to be the most well setup for aggressive growth in the first half of 2014.

The 15 recommended stocks for the first half of 2014 also performed very well over the past year and the past 3 years. As I have written before, the past is not a perfect indicator of the future, but it is probably the best indicator that we have to use.

I didn’t try overly hard to make this list of 15 recommended stocks to be a balanced portfolio covering multiple industries. I am happy to report that it isn’t a terrible unbalance. The most glaring omission is that it is very light in banking and in consumer technology. I simply could not find a banking stock that was worth the risk compared to other industries. Also, the consumer technology vertical is simply not performing that well right now. I anticipate that trend to continue for the next few months at least.

It might be possible to criticize this list by its heavy reliance on healthcare and retail. That would be fair but, once again, I wasn’t trying to get a perfectly balanced portfolio.

If you want a more balanced portfolio, you may want to consider some of the Honorable Mention stocks at the end of the list. Also, I always maintain that you should have approximately 30% of your portfolio invested in index funds. These funds should be divided by large and small cap funds, an index bond fund, and an index international fund. This would help to balance your portfolio.

You could also look at the Watch List of stocks. These stocks have shown that they are well-run companies. If you are concerned about a balanced portfolio, I suggest that you compliment the 15 recommended stocks with a couple stocks from the Watch List.

The list of 15 recommended stocks for the first half of 2014

- ABMD

- ALXN

- BCPC

- BLK

- BWLD

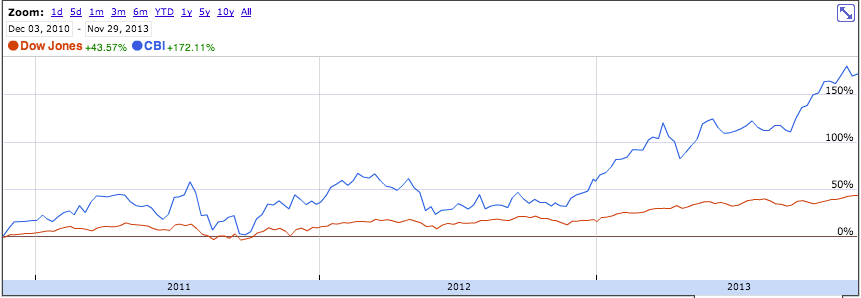

- CBI

- CERN

- GPOR

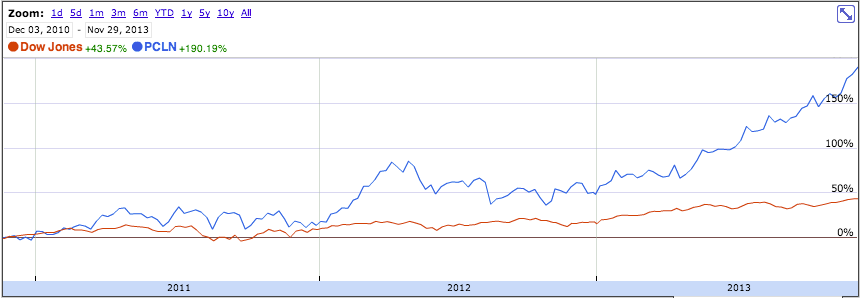

- PCLN

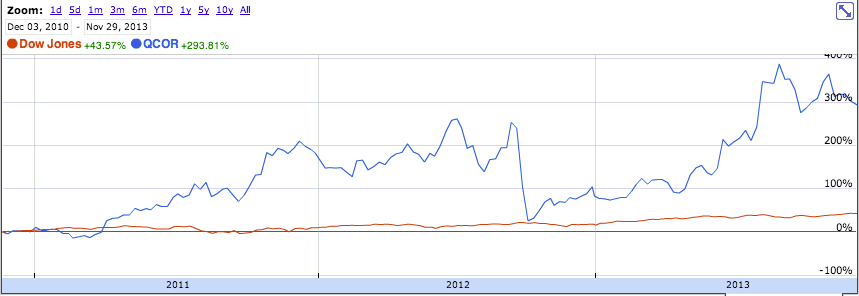

- QCOR

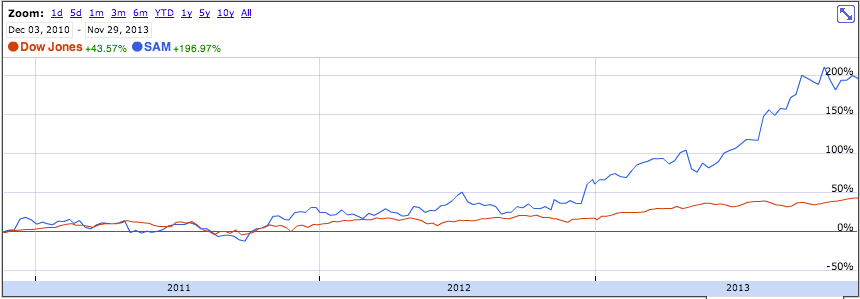

- SAM

- TMO

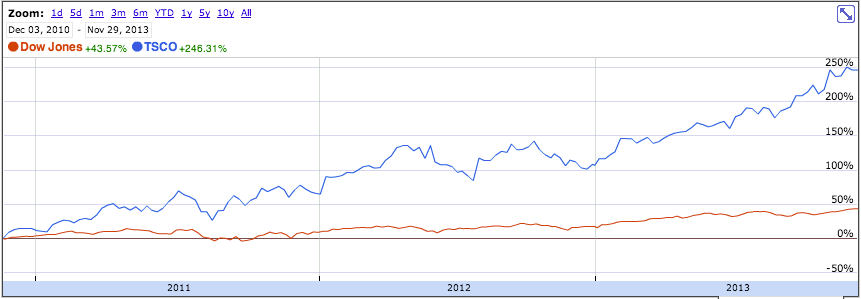

- TSCO

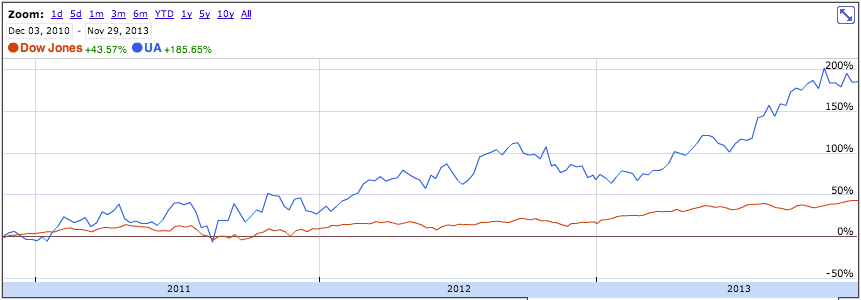

- UA

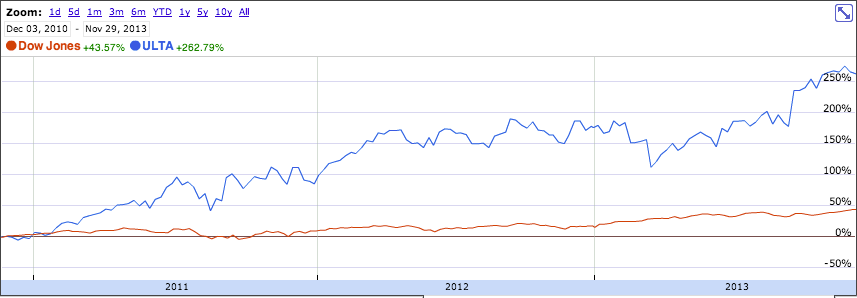

- ULTA

If you want to know a bit more about the companies that comprise the 15 recommended stocks for the first half of 2014, you can read below. The descriptions primarily came from the short paragraph descriptions on the company found on Google Finance. https://www.google.com/finance. The stock price charts also came from Google Finance. You can also click on a company name on the right side of this site, under the heading of Most Reviewed Companies (you may need to scroll down) as most of the companies on this list have been reviewed here several times.

ABMD [stckqut]ABMD[/stckqut] – ABIOMED, Inc. is a provider of mechanical circulatory support devices and offers a continuum of care to heart failure patients. The Company develops, manufactures and markets products that is designed to enable the heart to rest, heal and recover by improving blood flow and/or performing the pumping function of the heart. The Company’s products are used in the cardiac catheterization lab (cath lab) by interventional cardiologists and in the heart surgery suite by heart surgeons for patients who are in need of hemodynamic support prophylactically or emergently before, during or after angioplasty or heart surgery procedures.

ALXN [stckqut]ALXN[/stckqut] – Alexion Pharmaceuticals, Inc. (Alexion) is a biopharmaceutical company focused on serving patients with severe and ultra-rare disorders through the development and commercialization of life-transforming therapeutic products. Its marketed product Soliris (eculizumab) is the first and only therapeutic approved for patients with two ultra-rare and severe disorders resulting from chronic uncontrolled activation of the complement component of the immune system: paroxysmal nocturnal hemoglobinuria (PNH), an ultra-rare and life-threatening blood disorder, and atypical hemolytic uremic syndrome (aHUS), an ultra-rare and life-threatening genetic disease.

BCPC [stckqut]BCPC[/stckqut] – Balchem Corporation is engaged in the development, manufacture and marketing of specialty performance ingredients and products for the food, nutritional, feed, pharmaceutical and medical sterilization industries. The Company operates in three segments: Specialty Products, Food, Pharma & Nutrition and Animal Nutrition & Health. The Food, Pharma & Nutrition (FPN) segment provides microencapsulation solutions to a variety of applications in food, pharmaceutical and nutritional ingredients. The Company’s Specialty Products segment operates in industry as ARC Specialty Products. Ethylene oxide, at the 100% level, is sold as a sterilant gas, primarily for use in the health care industry. The Company’s Animal Nutrition & Health segment provides the animal nutrition and health markets with products derived from the Company’s microencapsulation, chelation, and basic choline chloride technologies.

BLK [stckqut]BLK[/stckqut] – BlackRock, Inc. is an investment management firm. The Company provides a range of investment and risks management services. The Company’s clients include retail, high net worth (HNW) and institutional investors, consists of pension funds, official institutions, endowments, insurance companies, corporations, financial institutions, central banks and sovereign wealth funds. The Company’s platform enables the Company to offer active (alpha) investments with index (beta) products and risk management to develop tailored solutions for clients. Its product range includes single- and multi-asset class portfolios investing in equities, fixed income, alternatives and/or money market instruments.

BWLD [stckqut]BWLD[/stckqut] – Buffalo Wild Wings, Inc., is an owner, operator, and franchisor of restaurants. The Company features a variety of menu items, including its Buffalo, New York-style chicken wings spun in any of its 16 types of sauces or five types of seasonings. The Company made-to-order menu also includes items ranging from Sweet BBQ to Blazin. The Company’s restaurants offer 20 to 30 domestic and imported beers on tap, including craft brews, and a selection of bottled beers, wines, and liquor. As of December 30, 2012, it owned or franchised 891 Buffalo Wild Wings restaurants in North America, of which 381 were Company-owned and 510 were franchised.

CBI [stckqut]CBI[/stckqut] – Chicago Bridge & Iron Company N.V. (CB&I) is one of the integrated engineering, procurement and construction (EPC) services providers and process technology licensors, delivering solutions to customers primarily in the energy, petrochemical and natural resource industries. CB&I consist of three business sectors: Steel Plate Structures, Project Engineering and Construction, and Lummus Technology. Through these business sectors, the Company offers services both independently and on an integrated basis. As of December 31, 2012, the Company had more than 900 projects in process in more than 70 countries.

CERN [stckqut]CERN[/stckqut] – Cerner Corporation is a supplier of healthcare information technology solutions, services, devices and hardware. Cerner solutions optimize processes for healthcare organizations. These solutions are licensed by 9,300 facilities globally, including more than 2,650 hospitals; 3,750 physician practices 40,000 physicians; 500 ambulatory facilities, such as laboratories, ambulatory centers, cardiac facilities, radiology clinics and surgery centers; 800 home health facilities; 40 employer sites and 1,600 retail pharmacies. It operates in two segments: domestic, which includes revenue contributions and expenditures associated with business activity in the United States, and global, which includes revenue contributions and expenditures linked to business activity in Argentina, Aruba, Canada, Cayman Islands, Chile, Puerto Rico, Saudi Arabia, Singapore, Spain and the United Arab Emirates.

GPOR [stckqut]GPOR[/stckqut] – Gulfport Energy Corporation is an independent oil and natural gas exploration and production company with its principal producing properties located along the Louisiana Gulf Coast in the West Cote Blanche Bay, or WCBB, and Hackberry fields, and in West Texas in the Permian Basin. During the year ended December, 31, 2011, it acquired its initial acreage position in the Utica Shale in Eastern Ohio. The Company also holds an acreage position in the Alberta oil sands in Canada through its interest in Grizzly Oil Sands ULC, and has interests in entities that operate in Southeast Asia, including the Phu Horm gas field in Thailand.

PCLN [stckqut]PCLN[/stckqut] – Priceline Com Incorporated, is an online travel company that offers its customers hotel room reservations at over 295,000 hotels worldwide through the Booking.com, priceline.com and Agoda brands. In the United States, it also offers its customers reservations for car rentals, airline tickets, vacation packages, destination services and cruises through the priceline.com brand. It offers car rental reservations worldwide through rentalcars.com. As of December 31, 2012, its international business (the majority of which is generated by Booking.com) represented approximately 82% of its gross bookings, and approximately 92% of its consolidated operating income. In 2012, the Company launched Express Deals, a merchant semi-opaque price-disclosed hotel reservation service at priceline.com, which allows customers to see the price of the reservation prior to purchase but not the identity of the hotel.

QCOR [stckqut]QCOR[/stckqut] – Questcor Pharmaceuticals, Inc. is a biopharmaceutical company. The Company is focused on the treatment of patients with serious, difficult-to-treat autoimmune and inflammatory disorders. Its primary product is H.P. Acthar Gel (repository corticotropin injection), or Acthar, an injectable drug that is approved by the United States food and drug administration (FDA), for the treatment of 19 indications. Its research and development program is focused on: the evaluation of the use of Acthar for certain on-label indications; the investigation of other potential uses of Acthar for indications not FDA approved; and the expansion of its understanding of how Acthar works in the human body (pharmacology), and ultimately, its mechanisms of action in the disease states for which it is used, or may be used in the future. The Company sells Doral to pharmaceutical wholesalers, which resell Doral primarily to retail pharmacies and hospitals.

SAM [stckqut]SAM[/stckqut] – The Boston Beer Company, Inc. (Boston Beer) is a craft brewer in the United States. During the year ended December 31, 2011, Boston Beer sold approximately 2.5 million barrels of its products (core brands) and brewed or packaged approximately 13,000 barrels under contract (non-core brands) for third parties. During 2011, the Company sold over fifty beers under the Samuel Adams or the Sam Adams brand names, seven flavored malt beverages under the Twisted Tea brand name, three hard cider beverages under the Angry Orchard brand name and one hard cider under the HardCore brand name. Boston Beer produces malt beverages and hard cider at Company-owned breweries and under contract arrangements at other brewery locations. The Company-owned breweries are located in Boston, Massachusetts (the Boston Brewery), Cincinnati, Ohio (the Cincinnati Brewery) and Breinigsville, Pennsylvania (the Pennsylvania Brewery).

TMO [stckqut]TMO[/stckqut] – Thermo Fisher Scientific Inc. (Thermo Fisher) is engaged in serving science. It operates in three segments: Analytical Technologies, Specialty Diagnostics and Laboratory Products and Services. It serves its customers through three brands: Thermo Scientific, Fisher Scientific and Unity Lab Services. Thermo Scientific is its technology brand. Fisher Scientific is its channels brand. Its Unity Lab Services offers portfolio of enterprise services for instruments and laboratory equipment. Unity Lab Services offers a network of service and support personnel. In April 2012, it opened a new demonstration laboratory and training center in Seoul, South Korea. In May 2012, it acquired Doe & Ingalls Management, LLC. In September 2012, it acquired One Lambda, Inc. In September 2012, Thermo Fisher opened its Molecular Biology Center of Excellence in Vilnius, Lithuania.

TSCO [stckqut]TSCO[/stckqut] – Tractor Supply Company is an operator of retail farm and ranch stores in the United States. The Company operates retail stores under the names Tractor Supply Company and Del’s Farm Supply and operates a Website under the name TractorSupply.com. The Company’s stores are located in towns outlying metropolitan markets and in rural communities, and offer a selection of merchandise, which include equine, pet and small animal products, including items necessary for their health, care, growth and containment; hardware, truck, towing and tool products; seasonal products, including lawn and garden items, power equipment, gifts and toys; maintenance products for agricultural and rural use, and work/recreational clothing and footwear. The Company operates at farm and ranch retail sales segment, both at its retail locations and online.

UA [stckqut]UA[/stckqut] – Under Armour, Inc. is engaged in the development, marketing and distribution of apparel, footwear and accessories for men, women and youth. The Company’s products are sold worldwide and are worn by athletes at all levels, from youth to professional, on playing fields worldwide. Most of its products are sold in North America. Internationally, Under Armour sells its products in certain countries in Europe, a third party licensee sells its products in Japan, and distributors sell the Company’s products in other foreign countries. In addition, it opened a store in China during the year ended December 31, 2012.

ULTA [stckqut]ULTA[/stckqut] – Ulta Salon, Cosmetics & Fragrance, Inc. is a beauty retailer, which provides one-stop shopping for prestige, mass and salon products and salon services in the United States. During the year ended January 28, 2012 (fiscal 2011), the Company opened 61 new stores. It operates full-service salons in all of its stores. Its Ulta store format includes an open and modern salon area with approximately eight to 10 stations. The entire salon area is approximately 950 square feet with a concierge desk, skin treatment room, semi-private shampoo and hair color processing areas. Each salon is a full-service salon offering hair cuts, hair coloring and permanent texture, with salons also providing facials and waxing.

The Honorable Mention List

- DECK

- EXR

- GOOG

- HLF

- HOG

- MNST

DECK [stckqut]DECK[/stckqut] – Deckers Outdoor Corporation designs footwear developed for both high performance outdoor activities and everyday casual lifestyle use. The Company markets its products under three brands: UGG, Teva, and Sanuk. The Company sells its products, including accessories, such as handbags and outerwear, through quality domestic and international retailers, international distributors, and directly to end-user consumers both domestically and internationally, through its Websites, call centers, retail concept stores and retail outlet stores. In addition to the Company’s primary brands, its other brands include TSUBO, a line of casual footwear; Ahnu, a line of outdoor performance and lifestyle footwear; MOZO, a line of footwear that combines running shoe technology with work shoe toughness for individuals that spend long hours working on their feet, and Hoka, a line of footwear for all capacities of runner designed to alleviate fatigue, impact and muscle strain.

EXR [stckqut]EXR[/stckqut] – Extra Space Storage Inc. is a self-administered and self-managed real estate investment trust (REIT). The Company owns, operates, manages, acquires, develops and redevelops professionally managed self-storage facilities. As of December 31, 2011, Extra Space Storage Inc. held ownership interests in 697 operating properties. Of these operating properties, 356 are wholly owned, and 341 are owned in joint venture partnerships. An additional 185 operating properties that are owned by franchisees or third-parties in exchange for a management fee, bringing the total number of operating properties, which it owns and/or manages to 882. The Company operates in three segments: property management, acquisition and development; rental operations, and tenant reinsurance.

GOOG [stckqut]GOOG[/stckqut] – Google Inc. (Google) is a global technology company. The Company’s business is primarily focused around key areas, such as search, advertising, operating systems and platforms, enterprise and hardware products. The Company generates revenue primarily by delivering online advertising. The Company also generates revenues from Motorola by selling hardware products. The Company provides its products and services in more than 100 languages and in more than 50 countries, regions, and territories. Effective September 16, 2013, Google Inc acquired Bump Technologies Inc. Effective October 22, 2013, Google Inc acquired FlexyCore, a developer of software.

HLF [stckqut]HLF[/stckqut] – Herbalife Ltd. is a global nutrition company. The Company sells weight management, healthy meals and snacks, sports and fitness, energy and targeted nutritional products as well as personal care products. It distributes and sells its products through a network of independent distributors, using the direct selling channel. The Company categorizes its science-based products into four principal groups: weight management, targeted nutrition, energy, sports & fitness and Outer Nutrition. As of December 31, 2012, it sold its products in 88 countries to and through a network of approximately 3.2 million independent distributors. In China, in order to comply with local laws and regulations, it sells its products through, sales representatives, sales officers, independent service providers and in retail stores.

HOG [stckqut]HOG[/stckqut] – Harley-Davidson, Inc. is the parent company for the groups of companies doing business as Harley-Davidson Motor Company (HDMC) and Harley-Davidson Financial Services (HDFS). The Company operates in the Motorcycles and Related Products (Motorcycles) segment and the Financial Services (Financial Services) segment. The Motorcycles segment designs, manufactures and sells at wholesale heavyweight (street legal with engine displacement of 651+cc) Harley-Davidson motorcycles, as well as a line of motorcycle parts, accessories, general merchandise and related services. The Company conducts business on a global basis, with sales in North America, Europe/Middle East/Africa (EMEA), Asia-Pacific and Latin America. The Financial Services segment consists of HDFS, which provides wholesale and retail financing and provides insurance and insurance-related programs primarily to Harley-Davidson dealers and their retail customers. HDFS conducts business principally in the United States and Canada.

MNST [stckqut]MNST[/stckqut] – Monster Beverage Corporation is a holding company. The Company develops, markets, sells and distributes alternative beverage, such as non-carbonated ready-to-drink iced teas, lemonades, juice cocktails, single-serve juices and fruit beverages, ready-to-drink dairy and coffee drinks, energy drinks, sports drinks, and single-serve still water (flavored and unflavored) with beverages, including sodas that are considered natural, sparkling juices and flavored sparkling beverages. It has two reportable segments, namely Direct Store Delivery (DSD), whose principal products comprise energy drinks, and Warehouse (Warehouse), whose principal products comprise juice-based and soda beverages. The DSD segment develops, markets and sells products primarily through an exclusive distributor network. The Warehouse segment develops, markets and sells products directly to retailers.

My typical disclaimer says that I may or may not have a holding of the stocks discussed in this article. This would be a bit misleading for this particular article. You can assume that I am currently invested in every one of these stocks at the time of this writing.

The glass globe image at the top of this article is courtesy of suphakit73 at FreeDigitalPhotos.net