Editors Note: An investor needs to be very concerned about having too many stocks that are influenced by the same market factors. Understanding these relationships can be confusing at times. This guest article by Troy does an excellent job of helping to explain this concept.

Guest Post by Troy Huot

Why do stocks trade up? Why do stocks trade down? When you invest in a stock you need to comprehend what jolts the equity you’ve investing in either higher or lower. One contributing factor may have nothing to do with the stock you own at all.

Arbitrage is not usually the reason your beloved stock gets hammered on any given day. The old adage, “everything happens for a reason” definitely holds true in relation to the stock market. Stocks trade in unison and typically stocks trade in unison by sector.

Stocks can be divided up into many sectors based on the type of business the company is involved in. Some sectors include, but are not limited to: energy, financial, health care, industrials, retail and technology. It is imperative that you know what sector your stock belongs to as the stock can increase or decrease in value based on competitors in their sector.

For example, Apple is in the technology sector and its direct competitors are Dell [stckqut]DELL[/stckqut] and Hewlett-Packard [stckqut]HPQ[/stckqut]. News could come out that Apple Macbook Pro computer sales are going to be lower than expected this quarter. As a result, the stock could sell off drastically. You could trade the news on Apple [stckqut]AAPL[/stckqut] knowing there is also a possibility that both Dell and Hewlett-Packard could decrease in price too. Why? Because investors will insinuate that the decrease in sales for Apple is a foreshadow for dismal computer sales for both Dell and Hewlett-Packard. This has a direct impact on all the companies which leads to a rainfall effect that could send all three stocks trading lower.

There are also many other indirect stock market links that investor’s must pay attention to. Apple and Hewlett-Packard may be directly connected but companies like Apple and Omnivision Technologies [stckqut]OVTI[/stckqut] have an indirect relationship. Omnivision Technologies creates and manufactures a semiconductor image sensor for the camera used in Apple iPhones: do you see the relationship here? It could come to light that iPhone sales have increased dramatically from first quarter to second quarter. This could lead to Apple’s share increasing in price as well as Omnivision Technologies stock since Apple uses Omnivision’s product in their iPhone.

Stocks trade higher and lower based on several other reasons including current commodity prices. If you are an owner of apparel maker, Lululemon Athletica [stckqut]lulu[/stckqut], then it is in your best interest to monitor the price of cotton. If the price of this commodity escalates, odds are Lululemon will trade lower due to the fact the company now has to pay more money to purchase cotton. Cotton is the main fabric used in clothing so it’s price can have a huge positive or negative impact on retail companies. If cotton costs increase for a clothing company but the price of merchandise sold remains the same then profitability will decrease which might disgruntle investors. A company like Lululemon can not simply just increase their price of a hoody or yoga pant either. Doing this could lead to losing customers to competitors which would hurt the company even more. Many clothing manufacturers like Nike [stckqut]NKE[/stckqut], Under Armour [stckqut]UA[/stckqut] and True Religion [stckqut]TRLG[/stckqut] could also perish from higher commodity prices and this is why stocks in similar sectors tend to trade together.

As an investor you must always be observant and understand direct and indirect relationships between companies that makes stocks trade together. This will indubitably help make you more money during your investing lifetime. Nonetheless, this will also help prevent you from making some terrible mistakes in the future which will have a direct, and indirect, impact on your bank account.

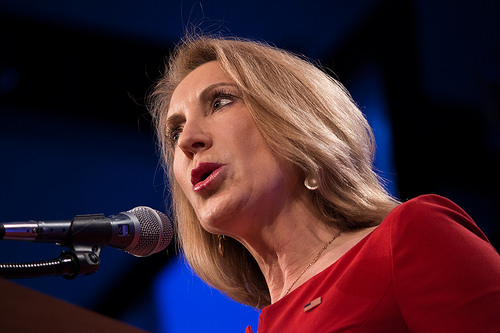

Carly Fiorina is currently a candidate for President of the United States of America. She is campaigning for the nomination of the Republican Party to run in the general election of 2016. According to her, one of her strengths is her business background. Most notable she speaks of her background as the first CEO of a DOW30 company: Hewlett-Packard [stckqut]HPQ[/stckqut].

Carly Fiorina is currently a candidate for President of the United States of America. She is campaigning for the nomination of the Republican Party to run in the general election of 2016. According to her, one of her strengths is her business background. Most notable she speaks of her background as the first CEO of a DOW30 company: Hewlett-Packard [stckqut]HPQ[/stckqut]. Ironically, her record at HP is one of the criticisms of Ms. Fiorina. Donald Trump is famous for criticizing her as a failed CEO, and he often cites

Ironically, her record at HP is one of the criticisms of Ms. Fiorina. Donald Trump is famous for criticizing her as a failed CEO, and he often cites