How badly did Apple ($AAPL) do? Evidently, pretty well

CNET recently put out an article discussing the most profitable US corporations. The article shows that even with Apple’s disappointing quarter that caused a major drop in stock price, Apple is still had more income than anyone else. The issue is that the analysts thought that the results were going to be even better, so the analysts were disappointed. When you disappoint analysts, they punish you by saying bad things. I am borrowing the great CNET chart below.

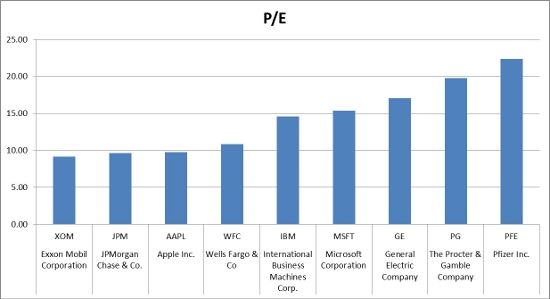

To this analysis, I would like show how cheap these stocks really are. While I try to not compare the P/E ratio of non-competitors, I think it is valid for this one exercise.

If we look at the P/E and EPS of these companies, it is quite telling how cheap Apple really is among this peer group.

|

Company |

Symbol |

P/E |

EPS |

|

Apple Inc. |

AAPL |

9.78 |

44.10 |

|

Exxon Mobil Corporation |

XOM |

9.17 |

9.69 |

|

Microsoft Corporation |

MSFT |

15.39 |

1.82 |

|

Pfizer Inc. |

PFE |

22.36 |

1.26 |

|

International Business Machines Corp. |

IBM |

14.57 |

14.41 |

|

JPMorgan Chase & Co. |

JPM |

9.64 |

5.20 |

|

Wells Fargo & Co |

WFC |

10.85 |

3.36 |

|

The Procter & Gamble Company |

PG |

19.76 |

3.90 |

|

General Electric Company |

GE |

17.08 |

1.39 |

It might not be obvious from looking at the above table of values. Looking at P/E as a chart shows that Apple is one of the cheapest stocks by comparing its price to the earnings of the company.

It really becomes obvious then by looking at the earnings per share in chart format!

So if you think that Apple’s days are done, you may want to think again! In fact, the biggest complaint that you can say about Apple is it seems that they are not getting enough shareholder value!

If you think that IBM is fairly priced for its earnings then it would be realistic that Apple could increase its share price by 50% if you focus on P/E! By looking at Microsoft, you could say that the price could go up 60%! This means that it is likely that Apple has more upside potential than downside risk.

My disclaimer on this site consistently says that I ‘might’ be long any stock I talk about. In this case, I am long on Apple as I write this article. However, as I consistently point out in my book, The Confident Investor, I didn’t pay for those shares! My current Apple holdings are all free. If you want to know how to get free stock in great companies, I suggest that you read my book. You can purchase my book wherever books are sold such as Amazon, Barnes and Noble, and Books A Million. It is available in e-book formats for Nook, Kindle, and iPad.