Facebook Posts Stellar Earnings, Even With Rising Costs, and Dominates in Mobile – Facebook ($FB)

Facebook, Inc. [stckqut]FB[/stckqut] has released its third quarter earnings and the numbers look solid on all fronts. That may not be a surprise after the other online and tech earnings we have seen. Still, Facebook reported that revenue was $4.501 billion — up from $3.203 billion last year, and above the $4.37 billion consensus estimate from Thomson Reuters.

Facebook’s adjusted earnings were $2.41 billion with an adjusted operating margin of 54%. That compares to $1.459 billion and 57% a year earlier. The adjusted earnings per share (EPS) was $0.57, versus $0.43 EPS a year ago and versus the consensus estimate of $0.52 EPS.

Of the $4.501 billion in revenues, some $4.299 billion was in advertising – up 45%. Facebook’s total costs and expenses rose by 68% to $3.042 billion. Excluding the impact of year-over-year changes in foreign exchange rates, the company showed that total revenue would have increased by 51%.

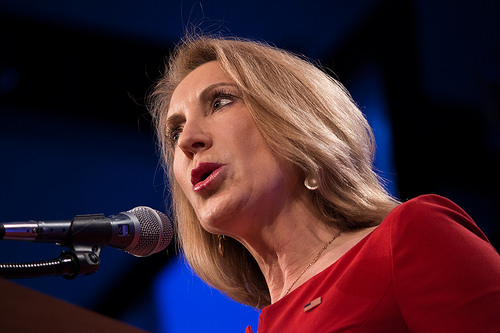

Carly Fiorina is currently a candidate for President of the United States of America. She is campaigning for the nomination of the Republican Party to run in the general election of 2016. According to her, one of her strengths is her business background. Most notable she speaks of her background as the first CEO of a DOW30 company: Hewlett-Packard [stckqut]HPQ[/stckqut].

Carly Fiorina is currently a candidate for President of the United States of America. She is campaigning for the nomination of the Republican Party to run in the general election of 2016. According to her, one of her strengths is her business background. Most notable she speaks of her background as the first CEO of a DOW30 company: Hewlett-Packard [stckqut]HPQ[/stckqut]. Ironically, her record at HP is one of the criticisms of Ms. Fiorina. Donald Trump is famous for criticizing her as a failed CEO, and he often cites

Ironically, her record at HP is one of the criticisms of Ms. Fiorina. Donald Trump is famous for criticizing her as a failed CEO, and he often cites